This article is the second of a six-part series on scaling financial inclusion as part of our digital transformation guide.

Most microfinance institutions originated as high-touch businesses, focused on meeting the needs of their customers through face-to-face interactions and cash-based transactions. While this model worked well to provide underserved populations with access to the responsible financial products they need, the heavy reliance on loan officers and physical branches results in higher costs and limits scalability. And during the pandemic, in-person contact has been off-limits in many communities.

The solution? Technology.

A purely digital financial services model — which relies on remote applications, processing, approval, and digital transactions — is very different from the high-touch, low-tech model of traditional microfinance institutions in ethos, culture, and style. But many financial service providers (FSPs) catering to the underserved face the reality that they cannot adopt a purely digital financial service model as some customers will continue to require high-touch service, while others may be comfortable transacting digitally. Therefore, the transformation of FSPs requires careful thought about how two very different operating models, one current and one future state, should be integrated under the same roof.

Putting digital transformation into practice

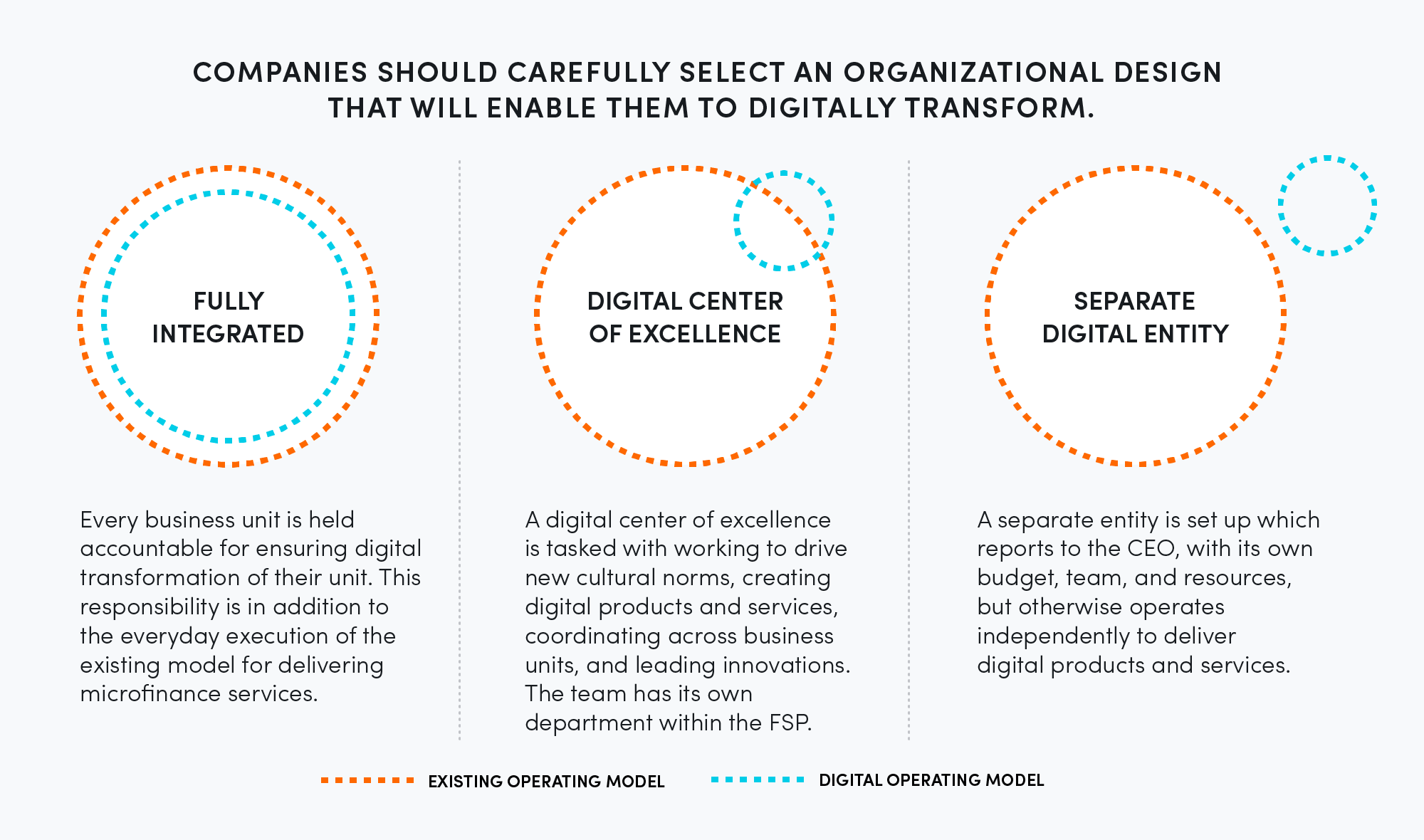

Choosing an appropriate operating model depends on institutions’ digital maturity and their desired end-state. While there is no right way to organize for digital transformation, there are three different approaches that companies can consider:

- Fully integrating digital processes across all departments

- Establishing a digital center of excellence within the organization to deliver new products

- Creating a separate digital entity, or wholly owned subsidiary, that operates independently

Keep in mind that organizational design can and should change over time. While some companies may like the dedicated focus of a separate or semi-integrated digital unit at the start, others may want to ensure digital capabilities become embedded across business lines over the longer term. To learn more, read Accion’s recently published digital transformation guide, developed in partnership with the Mastercard Center for Inclusive Growth.

Through our partnership with Mastercard, Accion is helping several financial service providers digitally transform so that they can serve small businesses and families more effectively. To accomplish this, we’ve implemented variations of these organizational design approaches:

1. Fully integrated digital transformation model

In a fully integrated digital transformation model, digital capabilities and processes are interwoven across business lines, with all departments responsible for driving business agility, growth, and innovation.

“Unless we create the overall organizational environment around the digital culture, just releasing a digital product [won’t] solve the problem because the whole support system has to come along.”

— Sasidhar Thumuluri, Managing Director and CEO, Sub-K IMPACT Solutions Ltd. in India

Sub-K IMPACT Solutions, a banking correspondent company in India, socialized digital transformation across their entire organization by utilizing town hall meetings at headquarters and in the field to educate employees on the value of digital. They trained nearly all staff to adopt a digital-first approach to customer acquisition, application processing, account servicing, and collections and put in place KPIs to drive forward a digital operating model. They also created several working groups with members from product, data strategy, training, compliance, marketing, call center, and agent networks to leverage the institution’s existing assets and infrastructure to offer a distribution model for digital products. These cross-functional teams work together to develop and implement digitally enabled, customer-centric products and services, ensuring Sub-K’s successful digital transformation and enabling the launch of their SARTHI fintech platform.

2. A digital center of excellence

When establishing a digital center of excellence, or innovation hub, FSPs must consider which existing assets within the business to leverage in new digital initiatives. Since this model requires departments like IT, marketing, audit, and compliance to significantly shift how they operate, plan, and resource themselves to support the new venture, it is crucial to make clear agreements on shared resources to achieve the organization’s priorities.

BancoSol serves more than one million low-income clients in Bolivia. They opted to develop an innovation hub responsible for leading the bank’s digital transformation to serve current customers better and shape BancoSol’s future. To encourage experimentation, they did not configure the innovation hub to have profit and loss (P&L) responsibility immediately. Instead, the hub received freedom to develop a digitally native identity and culture, working closely with other business lines to deliver new products and services and leveraging the bank’s existing capabilities, including the tech stack, marketing, and operational staff. Additionally, the innovation hub focuses on building cutting-edge capabilities in human-centered design, data analytics, and open innovation, which will be embedded within the FSP as the skills mature. As the center of excellence progresses, the vision is to transition to a standalone digital unit with its own P&L responsibility and acts as a service provider for the bank, charging for its services. This model has demonstrated success with DBS Asia X and the BRAC Social Innovation Lab.

3. Separate digital entity

A standalone digital unit is a powerful idea for many innovators in the industry. The allure of being able to build, test, learn, and launch products without having to worry about the FSP’s existing business operations is strong, but it is crucial that the strategy, focus, investment requirement, and management structure of the new unit is absolutely clear. One notable example is ALAT, Nigeria’s first fully digital bank. ALAT is a child company of the country’s oldest bank, Wema Bank. ALAT was built from the ground up to provide a branchless customer experience. Today, ALAT has over 200,000 active clients, is Wema Bank’s primary banking platform, and brings significant transformation to the Nigerian banking industry.

For an organization to determine the best model to start with, they should consider several factors: whether their existing operations already reach their target customers, macro-level factors such as access to talent and the potential for partnerships, the digital maturity levels of the country and institution, and finally, whether the company has a culture of openness to change.

If you are interested in optimizing the organizational design at your institution as you look to transform digitally, we are happy to help. Reach out to us.

Malavika Krishnan contributed to this article.