Chandra Kanthayadav was first inspired to open her business during the Festival of Rakhi one year in her hometown of Raipur, India. The popular Hindu festival is a celebration of the love between siblings and close friends, symbolized by people tying special woven bracelets called rakhis on their loved ones’ wrists. She saw how other shops in her community had great success during the festival, so she decided to open her own stall to sell rakhis and other items. Chandra quickly sold out of her inventory during that first festival and in the next festival after that.

Recognizing an opportunity to build a permanent business, Chandra opened a storefront adjacent to her family home and began searching for a way to stock her store with everyday household goods and seasonal items. At first, she borrowed from her family, friends, and other informal sources to pay for her inventory, but the higher interest rates and inconsistent availability of these informal loans prevented her from reaching her goals. Chandra found a better solution when she learned she could get funding through a more formal channel.

The power of financial services for women in India

Microcredit, small loans for low-income entrepreneurs, gives women in rural India access to the financing needed to strengthen their businesses and earn their own income. Chandra first took a group loan from Sub-K with women in her community that she’s known for over 17 years. Sub-K, a partner of Accion, is a financial provider focused on reaching underserved populations in India, especially focusing on women entrepreneurs in rural areas. Chandra has continued to work with Sub-K to purchase her inventory, eventually quadrupling her store inventory (stock) value from 5,000 rupees to 20,000 rupees. Next, she plans to expand her store to make room for increased inventory.

Sub-K celebrated their 10th anniversary in August this year. Over the past decade, they’ve helped millions of women like Chandra realize their entrepreneurial dreams, in turn instilling confidence, expanding financial literacy and stability, and improving household conditions for women and their families. As Chandra’s business continues to grow, she feels more respected in her community, and her success helps her provide for her children’s education. To reach more underserved micro, small, and medium enterprises (MSMEs) and individuals, Sub-K has launched a new digital financial tool called SARTHI.

Advancing financial inclusion through technology

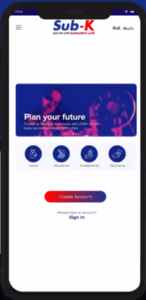

Sub-K uses an extensive agent network to reach micro, small, and medium entrepreneurs in rural areas who lack access to traditional banks. The company recently launched their new SARTHI fintech platform to complement this model and provide entrepreneurs with the tools they need to manage and grow their businesses. SARTHI will offer products like MSME credit, digital microloans, and health insurance that customers can access on their own mobile devices or with assistance from Sub-K’s staff and agents. SARTHI is integrated with multiple banks and third-party partners to provide customers with a wide variety of products and payment choices and quick application processing.

“This platform marks a major milestone in our digital transformation journey. We genuinely believe that the future is digital, and we are committed to bring a large segment of the excluded population into the mainstream by effectively leveraging the power of fintech,” says Sasidhar N. Thumuluri, Sub-K managing director and CEO. SARTHI was developed with advisory services provided by Accion through a global partnership between Accion and Mastercard.

Small businesses like Chandra’s are the backbone of the Indian economy, and they need financial services to weather challenging times and succeed in the future. We are proud to support Sub-K in their efforts as they move to the next chapter of advancing financial inclusion. Victoria White, the managing director of Accion’s Global Advisory Solutions, says, “Sub-K’s proven commitment to reaching last-mile customers, their expansive reach through their agent network and bank partnerships, and their demonstrated embrace of digital technologies made them an ideal partner for our efforts with Mastercard to help microbusinesses benefit in a digital economy. The launch of this platform is an important milestone in that effort.” By investing in digital tools that help microentrepreneurs build better businesses and better lives, we can bridge the financial services gap in rural India and bring financial inclusion to more people.