Person

Andrew Carlins contributed to this article

Inefficiencies breed innovations. With global supply chains seeking ways to diversify and reduce friction across stakeholders, verticalized and digital business-to-business (B2B) marketplaces have emerged as a promising solution that not only helps businesses flourish, but also drives economic development in emerging markets.

Vertical B2B marketplaces “go deep” by focusing on multiple operational aspects of a specific value chain, as compared to horizontal marketplaces which offer a wider assortment of products catering to multiple categories. Aside from providing a platform for participants in a specific industry to transact with one another more efficiently, these marketplaces also present new opportunities for historically underbanked micro, small, and medium businesses (MSMEs) to avail accessible and affordable financial services.

Accion Venture Lab’s India-based portfolio company Agrim, which focuses specifically on the agricultural sector’s retail value chain, is a great example of a vertically focused marketplace. By contrast, horizontal marketplaces like Alibaba or Udaan instead offer a wider assortment of products catering to a variety of segments. Such verticalization provides focus, consolidates resources to more effective channels, and enables deeper relationships with customers, thereby unlocking superior value and impact.

Our experience showcases that outstanding execution of a vertical B2B marketplace playbook requires a unique blend of operational excellence, an adept understanding of finances, well-managed cashflows, and an exemplary tech and product vision. Below, we’ll identify some top-level metrics that can help founders and investors gauge the health of verticalized B2B marketplaces.

Three key metrics to evaluate vertical B2B marketplaces

In short, we have identified that the “business health” of early-stage vertical B2B marketplaces can be measured by three key metrics: gross margins (GM), contribution margin 1 (CM1), and cash conversion cycle (CCC). Reflecting on our experience as investors, we want to provide some strategies that we have seen founders use to adjust these metrics, leading to a more solid footing for the long run.

1. Gross margin

The first of these three metrics is gross margin (GM), which is calculated as revenue minus the cost of goods sold (COGS). In general, GM is the bona fide indicator of the business attractiveness of vertical B2B marketplaces in a given segment. Even within a particular industry, the GM of vertical B2B marketplaces can vary significantly based on the types or categories of SKUs, or stock-keeping units, being bought and sold on the marketplace. Compared to horizontal marketplaces, verticalized marketplaces have fewer categories and therefore the margin of each category has a higher impact on the marketplace’s overall GM. This makes the category mix even more important in the context of GM of vertical B2B marketplaces.

Benchmark: We have seen that a gross margin of eight to ten percent is a healthy range for vertical B2B marketplaces. However, this benchmark varies based on industry, operating model, and geography the marketplace operates within. For example, a vertical B2B marketplace working upstream supplying to manufacturing industries would likely have higher GM compared to a marketplace supplying inventory to fast-moving consumer goods (FMCG) retail shops.

How to optimize gross margin: In working with founders building these marketplaces, we’ve identified four strategies that can help founders improve the GM of their marketplaces:

- Offer financing: Offering both off- and on-balance sheet lending options for buyers on the marketplace can add an additional 1 to 3.5 percent to the gross margin, respectively. Financing can also increase average order value and retention, which we’ll discuss later. We have seen that financing is easiest to implement for product categories where buyers have limited existing credit opportunities (i.e., payments are made on delivery without any delay), and we recommend offering financial solutions to buyers in those categories first.

- SKU-mix: We recommend identifying and promoting the SKUs that meet the dual criteria of having a high gross margin and being a fast-moving product in the segment. It’s important for the SKU to be fast-moving in the marketplace’s segment so that it constitutes a larger percentage of the overall gross merchandise value (GMV) enabling the SKU’s high-margin profile to impact the overall GM of the marketplace. Often, small pilots within a local or regional geography are a great technique to identify such SKUs.

- Source upstream: During the initial months of operation, B2B marketplaces typically rely on distributors or wholesalers as suppliers. We have seen that scale and dedicated business development resources focusing on sourcing more upstream can enable marketplaces to gain access to product manufacturers. Going directly to the manufacturer not only allows sourcing at a more affordable rate but also allows access to a wider assortment of SKUs which can further drive sales – and allow for greater SKU-mix options.

- Holding inventory: When B2B marketplaces hold inventory, they can procure in bulk from their suppliers. Bulk procurement typically provides marketplaces with the ability to negotiate lower prices, resulting in a higher gross margin. This isn’t a silver bullet, however: given that holding inventory can lead to higher working capital and inhibit scaling, founders should consider the market context and stage of their business before using this lever to increase GM. In our experience, ceteris paribus, we would recommend prioritizing working capital over chasing the extra GM that holding inventory can provide. At the same time, we encourage founders to be always mindful of the local context- We have seen founders build strong marketplaces by holding inventory where the buyers and suppliers are situated in geographically remote clusters and the buyers expect faster fulfillment. The founders in this situation invested in building a strong forecasting team which informed almost just-in-time procurement leading to less working capital being locked up.

2. Contribution margin 1

Contribution margin 1 (CM1) gives insight into the marketplace’s ability to sustainably deliver its products to the customer, and it is typically calculated as gross margin less direct costs (which, for B2B marketplaces, are predominantly logistics and warehousing costs).

Benchmark: Between the Seed and Series A growth period, we have seen that excellent founders focus on fulfillment operations to minimize direct costs and thereby increase CM1. Generally, a positive CM1 between zero to two percent is a healthy range for early-stage vertical B2B marketplaces. As with gross margin, however, this also varies across different industries and geographies. For example, in emerging markets with a high concentration of buyers in remote clusters, we have seen marketplaces build a hub-and-spoke model. In such models, the direct cost as a percentage of revenue remains high (and a negative CM1) until a threshold concentration of customers is achieved.

That said, we have seen that regardless of how asset-heavy a marketplace becomes, logistics costs are always significantly higher than warehousing costs, in some cases making up 60 to 100 percent of total direct costs. Therefore, in our view, strategies to optimize logistics are more consequential in decreasing direct costs at the early stages of marketplace development. On this note, we have seen that increasing average order value (AOV) can be a particularly effective lever founders can pull.

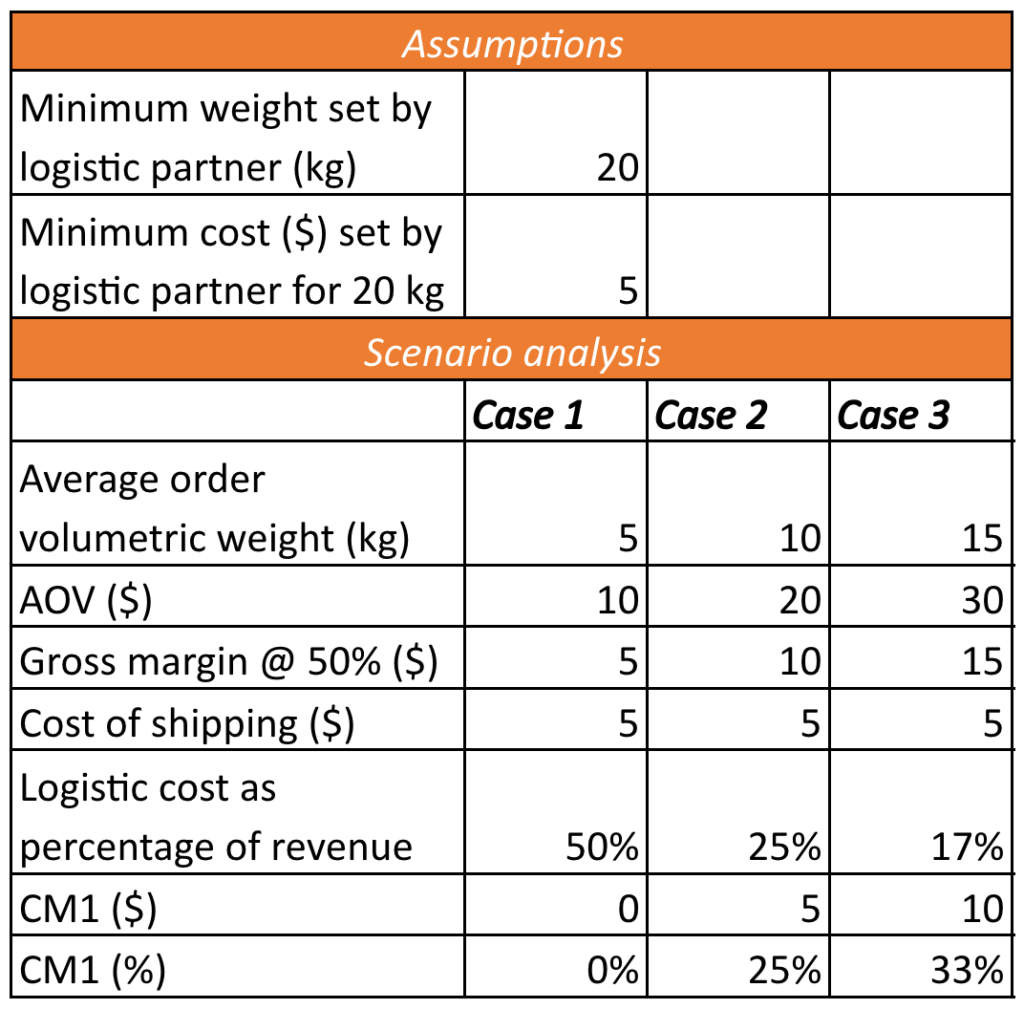

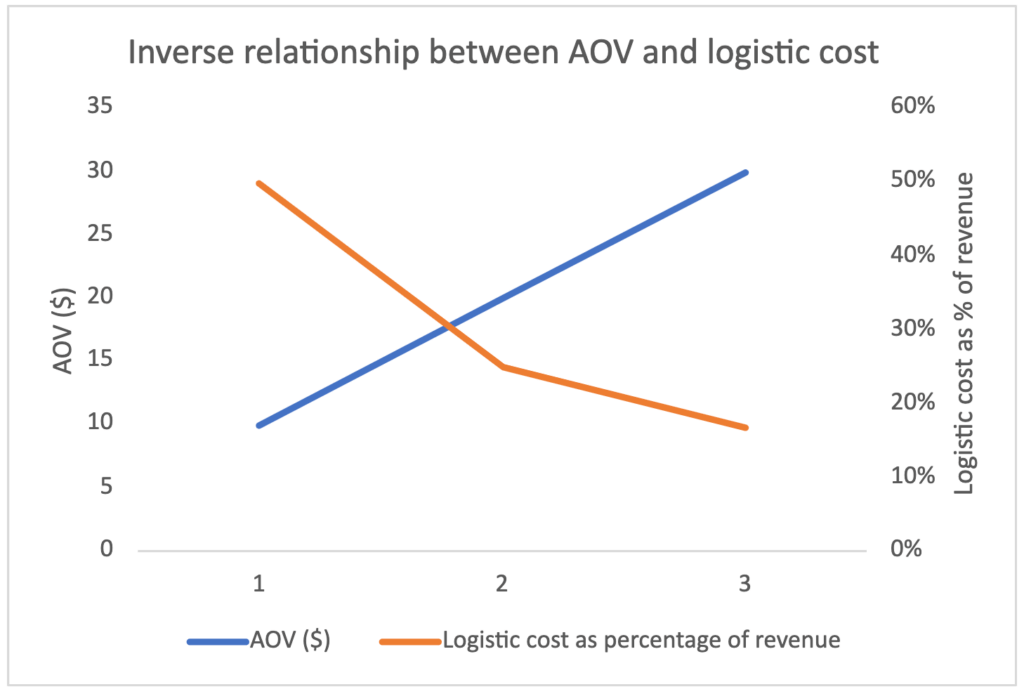

Increasing AOVs: AOV and logistics cost as a percentage of revenue are inversely related. We talk about logistics cost as a percentage of revenue to normalize the metric across businesses of various sizes. Increasing AOVs is particularly effective for B2B marketplaces that serve retailers where the typical volume of an order is small and thus occupies shared space in the delivery vehicle. In most of these cases, the logistics partner charges a minimum cost (e.g., $5) equivalent to a minimum volumetric weight (e.g., 15-20 kgs). Since the orders are usually between five and ten kgs, the logistics cost is not always fully optimized. As AOVs increase, the weight increases. However, the shipping cost does not increase until the weight reaches the threshold minimum weight. The illustration below further explains this relationship – and an opportunity to explore a novel way to manage this balance.

|  |

As demonstrated above, the business will want to increase its AOV till its equivalent volumetric weight equals the minimum weight set by its logistics partner. Doing so increases revenue but does not increase the shipping costs, which reduces logistic costs as a percentage of revenue.

We have seen marketplaces deploy a couple of interesting strategies to increase AOV:

- Financing: In emerging markets, MSMEs with limited or no access to capital face cashflow issues, translating into cash constraints during purchases. Offering financing during purchases acts as a powerful tool to not only empower the buyers but also increase the AOV of the marketplace.

- Carrot strategy: In general, it is best practice to pass on at least some of the shipping costs to buyers and never build a habit of free shipping. The carrot strategy is to incentivize higher AOVs by offering free shipping and other discounts on bulk orders.

- Innovative fulfillment strategies: The advantage of B2B marketplaces is that, unlike consumers, businesses frequently forecast, plan, and aggregate their purchases. We have seen founders further encourage planned purchases by offering instant or same-day delivery only by charging a premium on the shipping charge and promoting models such as deliveries on a fixed day of the week. This discourages instant small-value orders.

- SKU-mix: Keeping a keen eye on SKU-mix can also increase AOV or the overall volumetric weight of an order. High-value SKUs, such as pesticides, fungicides in agricultural value chains, or patented drugs in pharmaceutical value chains can increase AOVs. Before expanding into new product categories, founders should check the market appetite for these products, as SKUs with high value but low impact can provide an initial boost but rarely persist long-term.

3. Cash conversion cycle

The final metric key to B2B marketplace health is the cash conversion cycle (CCC). CCC indicates the number of days it takes a business to convert its inventory to cash and is calculated as Days Inventory Outstanding (DIO) plus Days Sales Outstanding (DSO) less Days Payable Outstanding (DPO). These measures are calculated as:

- DIO = the average number of days the marketplace holds inventory before it’s sold.

- DSO = the average number of days it takes for the marketplace to collect payment for a sale.

- DPO = the average number of days it takes for the marketplace to pay its suppliers.

Benchmark: While the smaller the value of CCC is, the better, 90 days is the maximum recommended CCC for early-stage verticalized B2B marketplaces. In practice, many of our portfolio companies maintain a far lower CCC of less than 10 days. We have found that such a single-digit CCC range is ideal as our experiences have demonstrated that banks consider longer CCCs risky, making access to working capital financing challenging. This situation gets exacerbated in economies where access to debt is more limited. Like other metrics mentioned, a CCC of less than 90 days should be taken as general guidance, as exact expectations vary based on industry, operating model, and geography. For instance, we would imagine a B2B marketplace in a more asset-intensive industry having higher DIO and by extension a longer CCC than other B2B marketplaces with no inventory holding.

Strategies: Reflecting on our experience as investors, we have found three strategic levers particularly effective for early-stage B2B marketplaces to pursue to reduce their CCC:

- Shift to a more asset-light model to reduce DIO: We have seen that B2B marketplaces can improve their cash flow by reducing the amount of inventory they hold. If the marketplace resells without additional value-add (e.g., branding or packaging), the best strategy is to not hold any inventory. However, the context of the market is important, and being completely asset-light may not always be feasible at an early stage. To strike a better balance, some of our portfolio companies have used machine learning tools to forecast demand and limit their warehouse inventory to only fast-moving SKUs. As the team gains more data on its customers’ buying patterns, the demand forecasting algorithm becomes smarter, and inventory purchases become increasingly streamlined, thus reducing DIO. Additionally, many B2B marketplaces will sell or provide their demand forecasting tool to suppliers on their platform as an added benefit.

- Reduce DSO: Recognizing the tightrope founders must walk when balancing cash flow and acquiring new customers, we wanted to highlight three strategies founders have used to improve their DSO while deepening their customer relationships:

- Blended approach: We have seen early-stage B2B marketplaces diversifying their SKU mix so that some SKUs are in categories that allow for payment on delivery, while other SKUs are in categories that are traditionally bought on payment terms. With this approach, B2B marketplaces have reduced their overall DSO while expanding their customer relationships.

- Negotiate terms with logistics partners: For B2B marketplaces in emerging markets where cash-on-delivery is the preferred mode of payment, the logistics partner often handles the cash. In these cases, the time between when the order is placed (revenue recognition) to when the logistics partner settles the payment with the B2B marketplace affects DSO. To this end, we have seen founders ensuring faster delivery times and renegotiating the time to cash settlement with their logistics partners, which has the simultaneous effect of improving DSO and making customers more satisfied with the platform.

- Offer financing: Financing options like buy now pay later (BNPL) can be a boon for cash-strapped SMBs and simultaneously reduce the transaction’s DSO. We have seen many early-stage B2B marketplaces initially collaborate with a lender to provide financing and then mature towards developing an in-house lending entity to start lending from its own balance sheet. As mentioned above, financing improves margins, so strategically prioritizing the rollout of these kinds of financial products can result in multi-faceted benefits to the company and its customers.

- Negotiate better payment terms with suppliers to increase DPO: As B2B marketplaces scale, we have consistently seen companies negotiate better terms with their suppliers. Our advice is to keep a close eye on the share of GMV a B2B marketplace’s orders represent to its suppliers, and strategically use the marketplace’s increased bargaining power to its advantage.

The recommendations we’ve outlined are meant to serve as high-level guidance for early-stage vertical B2B marketplaces, with the intent of giving a bird’s eye view into the health of these businesses. In our experience as investors and advisors of such marketplaces in emerging markets, we understand that many challenges are rooted in the local context of the market. Thus, the above strategies must be tailored for each business after considering contextual trade-offs. Above all, any strategy that sustainably delivers outstanding impact to the customer will translate to deep moats for the business; therefore, asking, “How will this benefit my customer?” is the first feasibility test for any new strategy.