Mrs. Cecilia is a microentrepreneur who lives in Villa Alemana, Chile, with her husband. The couple owns a small shop — known locally as a tienda — where they sell everyday items like food, cleaning supplies, and small gifts. She likes to keep the store stocked with a variety of goods so that customers can find everything they need. While Cecilia knows that the shop is making money, she doesn’t know what her real profits are on a monthly or annual basis. Cecilia’s son has tried to help his parents balance their accounts, but this task has proven difficult because Cecilia and her husband track sales in several different notebooks. When making a sale, they simply reach for the closest notebook and record the item and price sold. Cecilia and her husband’s process is typical of many microentrepreneurs around the world.

While this casual approach to tracking income gets small business owners through the day-to-day, it can hold them back from building their longer-term financial health. Accion is working with our partners to help entrepreneurs like Cecilia and her husband access financial tools that allow them to grow their businesses and stay resilient during hard times.

Small businesses across the globe are feeling the financial crunch from the coronavirus pandemic as customer volumes drop with more and more people staying at home. Times like this underscore the importance of preserving savings, planning for emergencies, and focusing on building greater financial resilience on an ongoing basis. Small businesses are critical drivers of the economy globally, and helping them build more financially healthy livelihoods will be a critical component of economic recovery from this crisis.

A digital path to better financial health

Cecilia is a client of Fundación Banigualdad, a nonprofit foundation in Chile that helps low-income microentrepreneurs access traditional financial services, giving them greater economic mobility and better equipping them to endure unstable times. In addition to issuing microloans, Banigualdad provides basic training in finance, marketing, sustainability, and business strategy. Organizame, a Chilean fintech company, seeks to help clients like Cecilia and her husband manage their income through an online financial health tool for small business owners that enables them to track their sales and expenses digitally and issue electronic invoices. The application captures a significant amount of data on merchant revenue streams that financial service providers can use to assess credit capacity and potentially offer more credit at better prices.

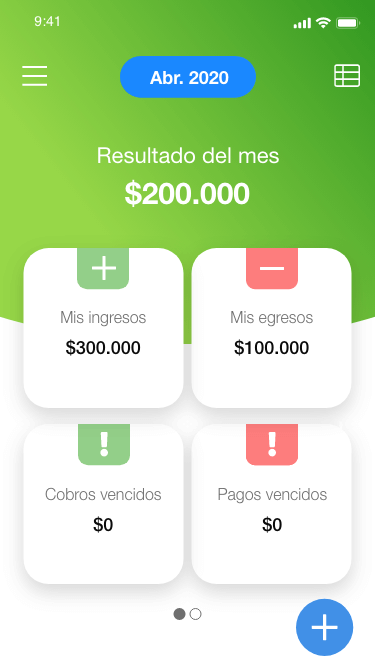

When entrepreneurs understand the cash flow of their businesses, they can make more effective and strategic long-term decisions and better prepare for unstable times. Accion is working with Organizame, with support from MetLife Foundation, to tailor their online business management tool to best serve Banigualdad’s low-income clients and help them improve their businesses. The mobile app digitizes business operations like cash flow management, bill payment, and credit applications to help entrepreneurs consolidate business transactions and send electronic documents. The app will build the user’s financial health by giving them a tool to calculate and view their profits, monitor their accounts receivable with notifications, learn how to keep their family and business accounts separate, and receive real-time support when they need it.

Through customer interviews, the Organizame and Accion teams learned that microentrepreneurs typically have a handle on their income, often by tracking sales in notebooks, but do not track their expenses in a systematic way. Microentrepreneurs confirmed that an app like Organizame’s would help them to have greater control over their expenses and even help them prepare for low sales months — a critically important task for them to stay resilient in uncertain times.

Building business management skills through gamification

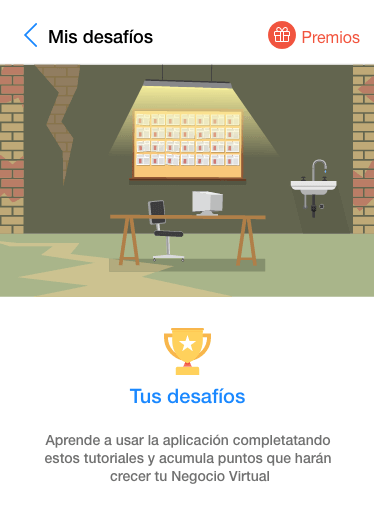

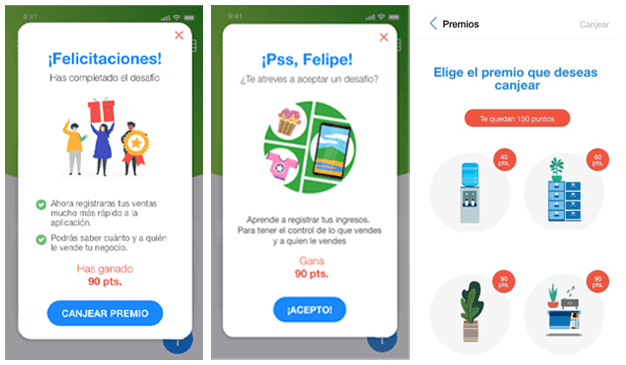

Despite the microentrepreneurs’ positive response to the app, Organizame knew that the main challenge would be encouraging microentreprenuers to consistently track their sales and expenses in a new digital platform after using notebooks throughout the entire life of their business. Knowing that simply educating entrepreneurs about the benefits of digital tracking would not be effective to change their behavior, the project team developed a game for microentrepreneurs to play within the application that would encourage and incentivize them to register their daily sales and expenses in the platform.

Immediately after downloading the application, users are introduced to a game that simulates a small fictional business. The user earns points as they complete tasks that help them learn how to use the app, like tracking the fictional business’ income and expenses. As users gain points, they can improve the virtual business.

The gamification feature aims to motivate users to register their income and expenses digitally and to educate entrepreneurs on how they can grow their businesses. It walks users through how to log sales by customer and how to keep track of what they owe their suppliers or what is owed to them. This is information that many entrepreneurs keep track of mentally and do not bother writing down. But, having this information in the app will give them a complete, objective picture of their current financial situation. Customers have told us that the app is fun to use and the reminders that pop up once a week are effective in reminding them to keep tracking their information in the app.

Changing people’s behavior is not easy, and the app will continue to evolve to ensure that the game effectively drives entrepreneurs to see the value in digital tracking of their income and expenses. Cecilia has told us that this app will help her family to have greater control over their finances. She is excited about the fact that she and her husband will have aggregated monthly sales and expenses at their fingertips, which will help them to make better and quicker decisions about when to take out credit, how to price products, and what they can save on a monthly basis.

Small businesses — the backbone of economies around the world — are more vulnerable than larger companies to financial shocks. By giving microentrepreneurs the tools they need to manage their businesses day-to-day and plan for financial shocks, we can ensure that they are better prepared during unexpected and challenging times and have a path to a better future.

This product is a part of our Building Financial Capabilities and Strengthening Institutions through Customer-Centered Innovations project, supported by MetLife Foundation.

The application asks the user if they will accept the following challenge: “Learn how to register your income so that you have better visibility into what you have sold to which customer.” Once completed, they earn 90 points. The user is then shown a list of products that they can purchase with their point balance to improve their virtual business.