This article is the last in a six-part series on scaling financial inclusion to accompany our digital transformation guide.

Partnerships are crucial to a successful digital transformation — enabling new ways to leverage data, evaluate risk, reach new customers, develop innovative products and services, and strengthen customer touchpoints. But financial service providers (FSPs) need to carefully consider when, how, and with whom to partner. As FSPs grow and evolve digitally, the right partners will help accelerate the transformation agenda, bringing in agility and expertise beyond the FSP’s core competencies.

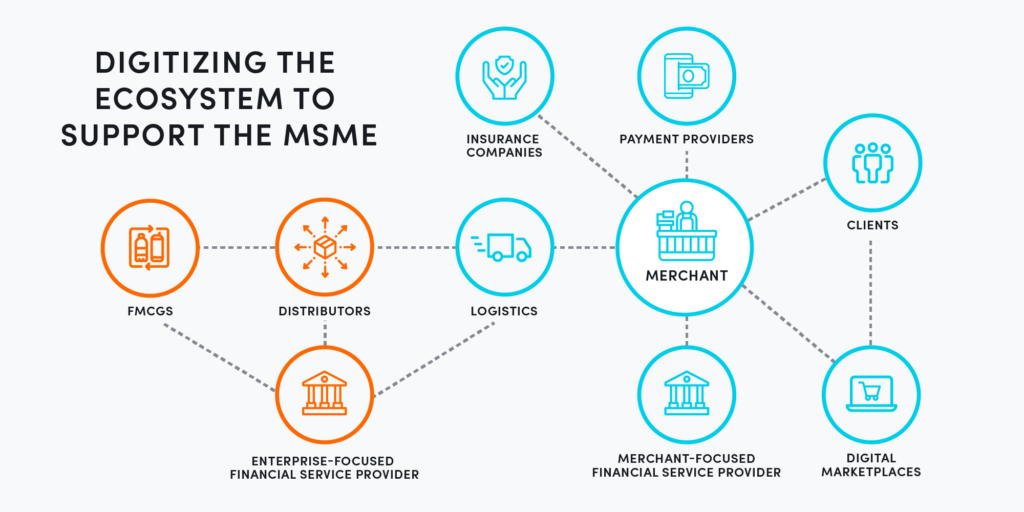

Partnerships are also critical to expanding the reach and uptake of financial products among underserved people by supporting the development of a 360-degree digital financial ecosystem. Of course, providing customers with digital financial products is only useful insofar as the financial ecosystem in which the customer operates has digital capabilities across the value chain, including merchants and suppliers accepting digital payments. Failing to digitize the broader ecosystem creates bottlenecks within digital financial transactions that will slow the adoption of digital financial services. To drive the ecosystem’s transformation, FSP partnerships with enabling actors are emerging, such as those with mobile network operators focused on enhancing mobile payments and increasing the usability of payment-related technologies. As the density of digital services available within an ecosystem grows, so too will the digital comfort of end customers.

However, some FSPs tend to view partnerships through the narrow lens of a vendor relationship, rather than seeking to create something that is greater than the sum of its parts. While the sticking point for many partnerships is a question of who owns the customer relationship and their data and a lack of a clear business case that aligns the goals of all parties, there are many ways to address these issues to build effective partnerships.

Establish win-win partnerships

Partnerships are successful when both entities collaborate on how to reach shared goals, moving beyond a mere vendor-bank relationship. BancoSol, Bolivia’s largest microfinance institution, was able to develop their latest customer mobile banking app completely in-house with their first-class IT team. But when they planned to upgrade to a 3.0 version, they partnered with fintech startup Flourish to get to market within 100 days. As a tactic to increase savings deposits to drive engagement within the revamped customer app, BancoSol layered Flourish’s gamification functionality on top of the bank’s digital assets. In this case, Flourish was able to combine its knowledge of behavioral science together with BancoSol’s strong understanding of their customer to develop a captivating engagement strategy. This partnership was a win-win for both entities: Flourish was able to enter the Bolivian market and BancoSol was able to get to market faster.

Partnerships can serve as a mutually beneficial go-to-market accelerator, benefitting both an FSP looking to scale their digital offerings and an e-commerce platform looking to grow their customer base, for example. That’s why Accion Microfinance Bank (Accion MfB) in Nigeria teamed up with African e-commerce giant Jumia to help onboard their MSME customers onto the Jumia platform to boost sales and increase MSMEs’ comfort and trust in using digitally enabled tools to run their businesses. Through this partnership, Jumia will be able to grow its customer base and provide them with access to Accion MfB’s credit offering, while Accion MfB will be able to leverage e-commerce sales data to underwrite digital working capital loans.

Expand your definition of partner

Having invented a crowdsourcing model for Colombian citizens to map their own cities by posting missions and offering point-based rewards to those who complete tasks, CÍVICO was accustomed to thinking outside the box. With this methodology, they were able to build out the most comprehensive picture of local small businesses and gain a better understanding of what financial services those merchants might need.

But for CÍVICO’s new digital lending product to be viable, the company needed to find a cost-effective way to mitigate risk by verifying the business location of their online applications. Rather than deploying CÍVICO staff to visit every potential customer, which would be expensive and time-consuming, CÍVICO turned again to their crowd-sourcing platform. Reimagining the traditional concept of a partnership as an alliance between two independent entities, CÍVICO created new missions where individual citizens were asked to collect information related to perceived sales activity and verify the location of the business by taking a picture.

In the few cases where the business could not be verified in this way, CÍVICO would then deploy other more resource-intensive channels to verify the customer, either by phone or in-person visits themselves. This crowdsource-by-default design enabled an OPEX light business model by leaning on the existing relationships the company had created through their gamified crowdsourcing platform.

Our global partnership with Mastercard has laid a solid foundation toward our goal of helping millions of people and small businesses participate in and benefit from the digital economy. While digital transformation is a continual and never-ending process, strategic partnerships across the value chain can help drive the uptake and usage of digital products so that low-income individuals and merchants reap the benefits of digital financial services.

If you’re interested in partnering with us, please reach out to see how we can work together.

Malavika Krishnan contributed to this article.