Authors

- Priya Punatar

- Yanina Seltzer

Topics

- Consumer Protection

- Customer Centricity

- Digital Financial Services

- Digital Transformation

- Financial Capability

- Financial Health

- Fintech

- Governance

- Human Centered Design

- Microfinance

- Personal Financial Management

- Resilience

- Responsible Digital Finance

- Responsible Product Design and Delivery

- Small Business Owners

- Underserved Groups

- Women

The pandemic has spurred a global economic downturn and widespread uncertainty about the future. The 3 billion people who are still left out or poorly served by the global financial system are uniquely vulnerable to the effects of COVID-19. They typically rely on daily, in-person interactions to get paid or buy food for their families and the unexpected loss of income for many families has made financial services and a focus on financial health more important than ever.

Financial health assesses whether people are spending, saving, borrowing, and planning in a way that will enable them to be resilient and pursue opportunities over time, as stated by The Financial Health Network.

A person’s financial health is determined by their:

- ability to manage day-to-day expenses,

- resilience against shocks and risks, and

- effective planning for the future and upward mobility.

As economies fluctuate, individuals are turning to financial institutions for added support and security in their lives. Having financial services can enable people to better manage their finances as they navigate the current crisis, save money for a brighter future, protect their families from future shocks, and rebuild their businesses—promoting resilience in the face of crisis.

However, according to a Gallup Global Financial Health study, access to traditional financial products does not automatically result in improved financial stability, resilience, and access to opportunity. Many traditional financial products were not developed with these pragmatic goals in mind. As a result, they are often poorly suited to helping people, especially low-income individuals, achieve their financial goals. To serve customers as they seek to recover from the economic fallout caused by COVID-19, financial service providers have an opportunity to better utilize customer data, behavioral science, and design thinking to create products and services that support households through shocks, that build resilience and enable them to better manage their financial lives. Well-designed products relevant to customers’ lives can lead to feelings of stability, peace of mind, and hope.

To do this, financial service providers should expand their financial inclusion strategy to focus on financial health. This goes beyond traditional access to services, in order to support people’s lived experiences and aspirations. These lived experiences are influenced by several aspects, including but not limited to age, sex, gender, occupation, marital status, dependents, household responsibilities, financial standing, physical and mental health, and emotional characteristics. Financial health is a perpetual journey — not just a snapshot in time. By developing personalized financial products, services, and experiences that better meet users’ needs and preferences, providers can ultimately create more meaningful change in people’s lives.

Financial products and services that truly work for users and fit their lives will ultimately drive more (and better) business for financial service providers. A business strategy oriented around consumer financial health offers providers an avenue for growth, organizational resilience, and profitability. In addition, it will offer financial service providers better opportunities to differentiate from the competition, especially today, when users are more and more sophisticated and demanding better interfaces that enable faster ways to interact with their financial reality.

The World Economic Forum noted that “[b]y aligning the success of their business with the success of their customers, financial providers have seen that the future of financial services is one in which the industry will thrive when their customers prosper.”

Designing services for the people who need them

To ensure that financial services deliver greater benefits to customers and that our aspirations for achieving financial health are attainable, Accion’s Global Advisory Solutions is advocating for a new approach to product design that combines data science, behavioral science, and design thinking. Together these three disciplines put the customer, rather than the product or the service provider, at the center of product or service design. These methods give providers better visibility into household cash flow fluctuations and customer pain points to design products, services, or experiences that are more useful, convenient, and beneficial. These methods can also help providers reach new market segments, retain customers, and improve customer lifetime value across their business.

Despite increasing access to financial services, use of formal financial products continues to lag, particularly in emerging markets. There are many reasons for this lack of uptake. Accion investigated this lag through hundreds of customer interviews globally in the last few years. The interviews revealed that customers do not find the few formal services available to them valuable or trustworthy, and that they are difficult to understand and cumbersome to use. What people really want is to pay tuition, expand or repair their homes, and to be prepared in case of weather or health emergencies. For this, many rely on informal services, like rotating credit groups and store credit, which are embedded in their communities, and are convenient, flexible, and available when and where people need them.

Data, behavioral science, and design thinking can serve as a starting point for financial service providers as they build greater trust with their customers and incorporate a financial health approach, while articulating the business reasons for doing so.

Using data, behavior, and design to build clients’ financial health

Creating products that build underserved customers’ financial health requires that providers become more familiar with their customers’ financial goals and behaviors. This means that financial institutions need to move away from product-centric approaches to become customer-centric.

Providers can become customer-centric by combining these three areas:

- Data: Examine available transactional, market, and business data to reveal user patterns and behavior and build solutions that leverage that knowledge,

- Behavioral Science: Use principles of behavioral science to better understand customer decision-making and overcome barriers to action, and

- Design Thinking: Employ design thinking to build empathy with customers, and understand the context of their lives, needs, preferences and habits.

These three ways of developing products and services are independently valuable and can achieve even greater success when leveraged together.

Data

Most providers have a wealth of internal and market data that they can leverage to better understand their customers. For example, transactional data can reveal how seasonal patterns and demographic characteristics relate to product use, repayment, churn, and retention. Providers can use this data to better target and schedule service promotions, reminders, and support interventions. For example, Destácame — a digital platform that financially empowers its users by raising their awareness of their financial data and improving their access to financial products — uses customer data to target product offers.

Using data to inform services and products can result in a variety of business benefits. A Consultative Group to Assist the Poor (CGAP) study found that using digital data to explore more scalable delivery methods could reduce the marginal costs of delivering a small loan by up to 30 percent. Accion noted in Unlocking the Promise of (Big) Data to Promote Financial Inclusion, organizations with greater access to data are more likely to succeed. Investing in the use of data during initial product design can also help organizations save over time. Design expert Susan Weinschenk claimed that “fixing an error after development is up to 100 times as expensive as it would have been before development.”

Furthermore, data can also be used to predict future behavior. Amazon uses predictive analytics to restock inventory and predict customer purchases, which reduces costs and delivers value to customers. Similar approaches to data analytics are allowing financial service providers to predict when users might need credit or a repayment pause, or when they could benefit from a savings product. In these instances, offering the right product at the right time can help build customers’ financial health.

Institutions need to store data responsibly and protect client information.

Moreover, data analytics can inform providers on what to consider in developing new products or features when targeting new customer segments. In Tanzania, an Accion partner wanted to refine an existing product that had not been performing well. By analyzing its transactional data, our partner was able to re-segment its customer base and identify a large sub-segment that had not being adequately served by either the partner or their competitors. The provider then tailored the product specifically for this newly identified sub-segment. Providers must invest in information storage and mining capabilities in order to reap these benefits.

Another institution, Annapurna Finance Pvt. Ltd. (AFPL), uses geographic information systems (GIS) around each of its branches to highlight the density of the population as well as economic activity. They also use a credit bureau report at the pin code level to understand the rates of indebtedness and delinquency in the regions that AFPL serves. Cross-referencing this data helps AFPL to better understand the needs of potential customers and to identify products and services to best serve them. For example, AFPL can then provide more targeted financial and technical support to these clients to strengthen their entrepreneurial skills.

Analytics can be supplemented by qualitative research to uncover meaning behind the data. Increasingly, designers are working with businesses to discover and leverage their findings regarding customers’ motivations, habits, and preferences to inform product and operational decisions.

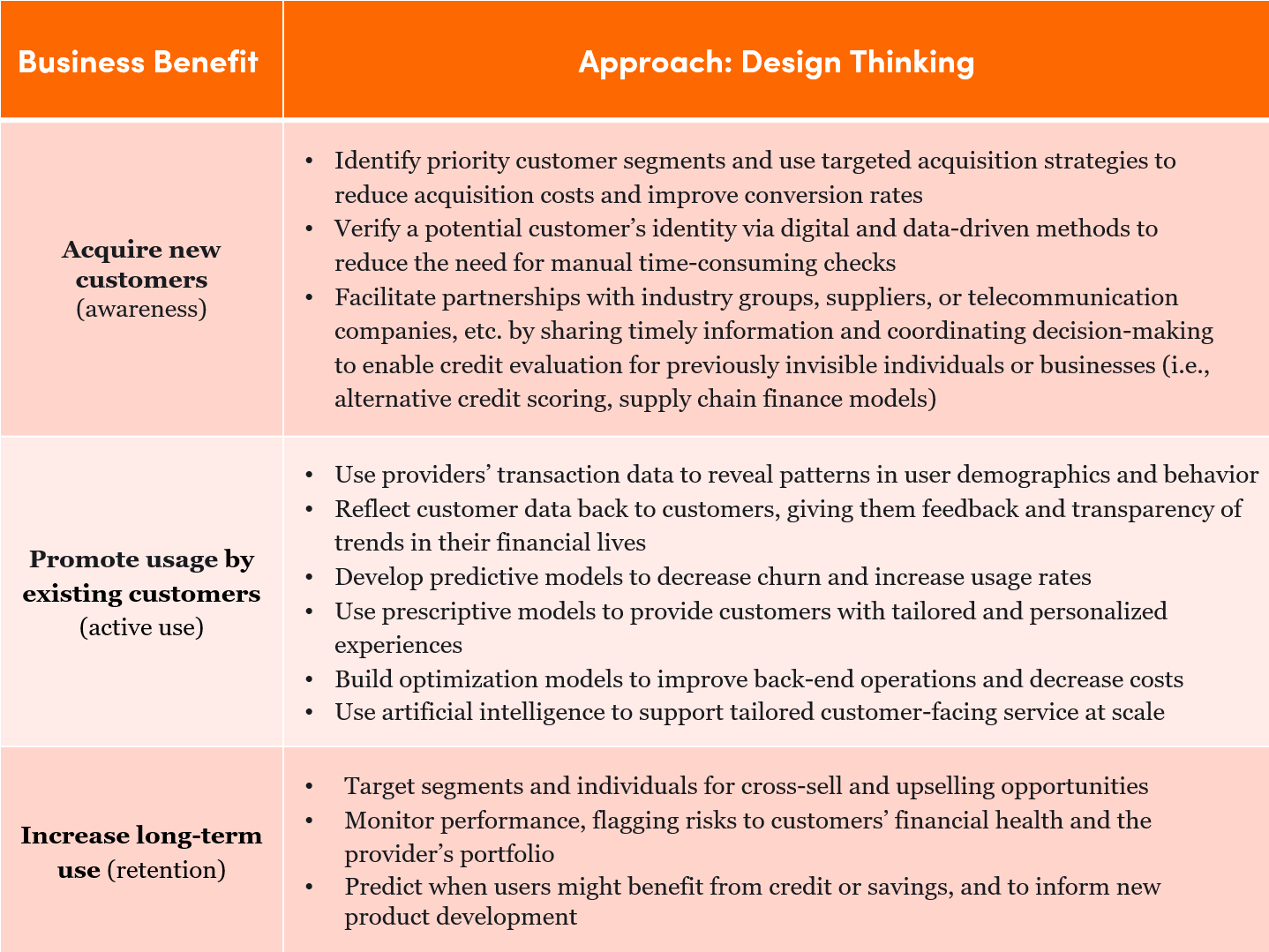

Table 1. The business case for data

Behavioral science

Behavioral science is being applied across the world to help individuals and organizations achieve their goals and organizational outcomes. Behavioral science emphasizes that humans are not robots. We are impacted by the environment and context in which we make decisions. How information is presented and phrased (and who delivers it) impacts how customers make decisions and behave.

According to the Organization for Economic Co-operation and Development (OECD), there are 200+ institutions globally applying behavioral science. These institutions help individuals and organizations achieve their desired goals and outcomes, including enabling people to make better financial health decisions. Many organizations have developed frameworks on how to apply behavioral science principles. One widely used framework from the Behavioral Insights Team (BIT), encourages organizations to make things: easy, attractive, simple, and timely (EAST).

Behavioral science seeks to understand how humans actually behave, rather than exclusively listening to how they want to behave or how they would behave in a perfect context. For example, behavioral science suggests that people are more likely to save when they set aside small amounts over time for specific goals. By developing products that account for and design for these behavioral principles, providers can positively influence financial behaviors while building customers’ financial health. For example, when Ideas42 and Women’s World Banking used behaviorally framed SMS messages to recruit women, female customer sign-ups increased by 64 percent.

One famous example of applied behavioral science in the financial industry is the use of defaults for U.S. employer-sponsored retirement plan (401(k)) contributions. By setting an automatic annual increase of income contribution to an individual’s 401(k), employees were able to increase their savings rate over 40 months compared to employees who had not set up auto-contributions. This default design helped earn Richard Thaler the Nobel Prize in Economics. Behavioral scientists have embraced this as the concept of “set it and forget it.”

Similarly, Accion is applying these principles to help Caja Alianza Cerano — a small financial cooperative in Guanajuato, Mexico – develop a goal-based application that allows youth to save or take out a small credit-building loan for a specific goal. The app is designed to harness the power of automation through an AutoPay feature that makes credit payments and automatic savings easy and frictionless for customers. Even though it seems like a simple switch, this allows more seamless movements of money into the system and provides less friction for users.

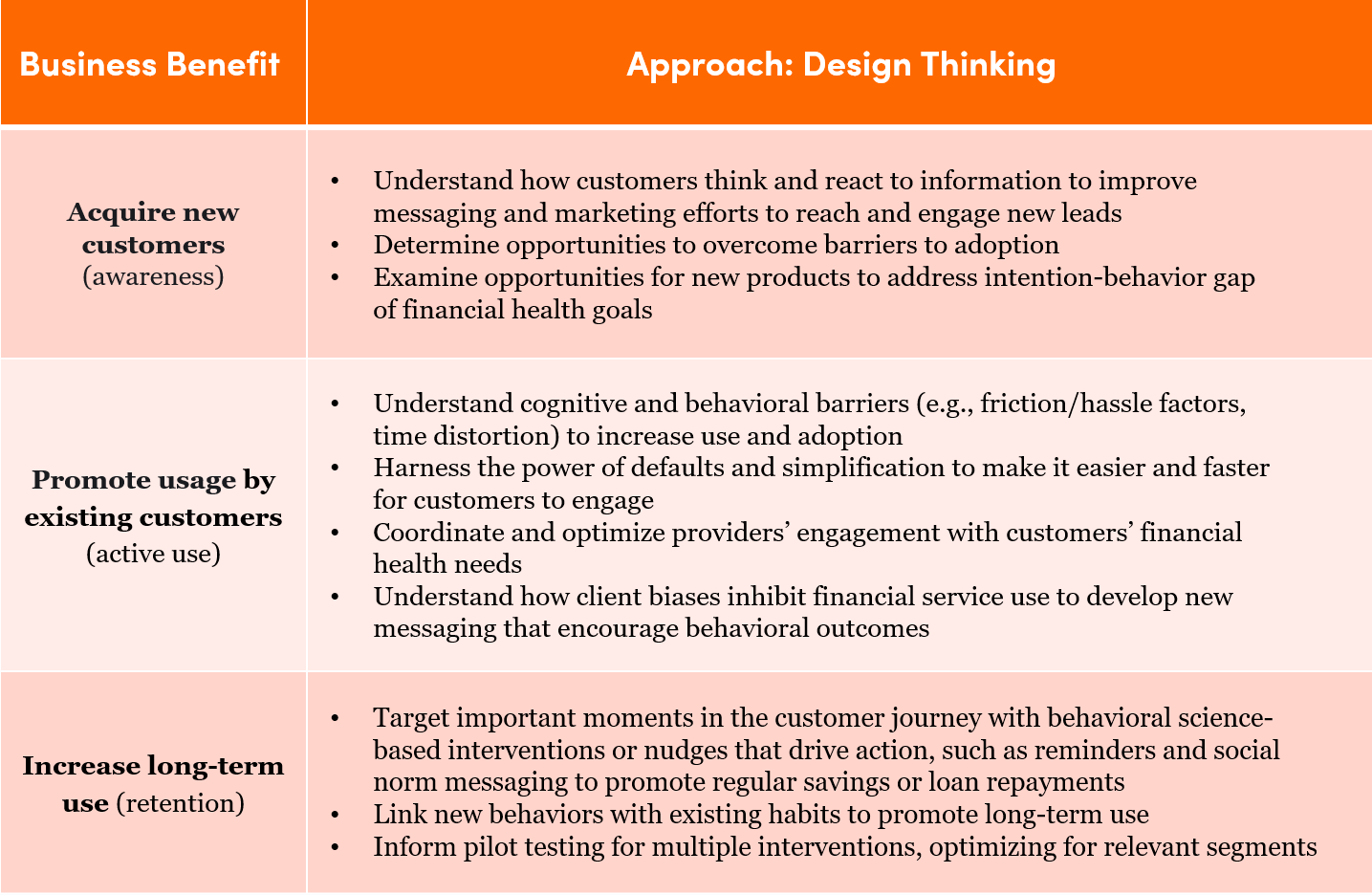

Table 2. The business case for behavioral science

Design thinking

As explained by Tim Brown, the CEO of IDEO, Design Thinking “is a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Delving deep into understanding the needs and realities of individuals allows providers to design better products, services or experiences that build trust and the financial health of customers. In some cases, it demands that providers embrace a longer-term horizon centered on customer-lifetime value.

Successful instances of human-centered design bring a balance of desirability, viability, and feasibility to the product; which allows an institution to not only design with its end user in mind — to develop an intuitive, engaging, and painless user experience to meet the customer’s goals—but also, to ensure that the design is grounded in technical and business reality. The testing of prototypes, whether they are simple drawings on sticky notes, or more sophisticated prototypes that look like an application, ensures that bad ideas fail rapidly and inexpensively, and good ideas are consistently improved upon. By doing this, institutions can save huge upfront investments in technology developments until they have developed a product or experience that fully resonates with end users.

Design thinking requires that financial service providers invest in understanding who their customers are and what they need. Staff need to meet the customers who have traditionally been left out of the financial sector and spend time in their communities, homes, and businesses. By getting to know their customers’ lives and realities, providers can understand, empathize with, and design for their pain points, habits, priorities, and aspirations, even as these shift over the course of their financial health journey.

Accion worked with Aye Finance to help their clients build a digital transaction history, which would give them more convenient and frictionless access to Aye’s financial services. Rather than entering the project with a predefined idea of how they were going to deliver value to the target market, the organization conducted one-on-one interviews with customers to understand the pain points that they face in running and growing their businesses. They found that business owners needed a more convenient means of recording and consolidating income and expenses and a simplified way to manage inventory. Given this finding, Accion and Aye Finance set out to design a mobile app that encourages Indian entrepreneurs to digitize their bookkeeping to give them more control and oversight over their businesses. Aye Finance developed a dedicated team for this project to ensure that the product was not only centered on the user’s reality, but technological and operational realities as well, and built upon a solid business case, based on projections. In just three-months after launch, the app was downloaded more than 1000 times, despite the pilot operating across only 4 branches. Aye Finance has integrated learnings from the development of the app into subsequent tools and products.

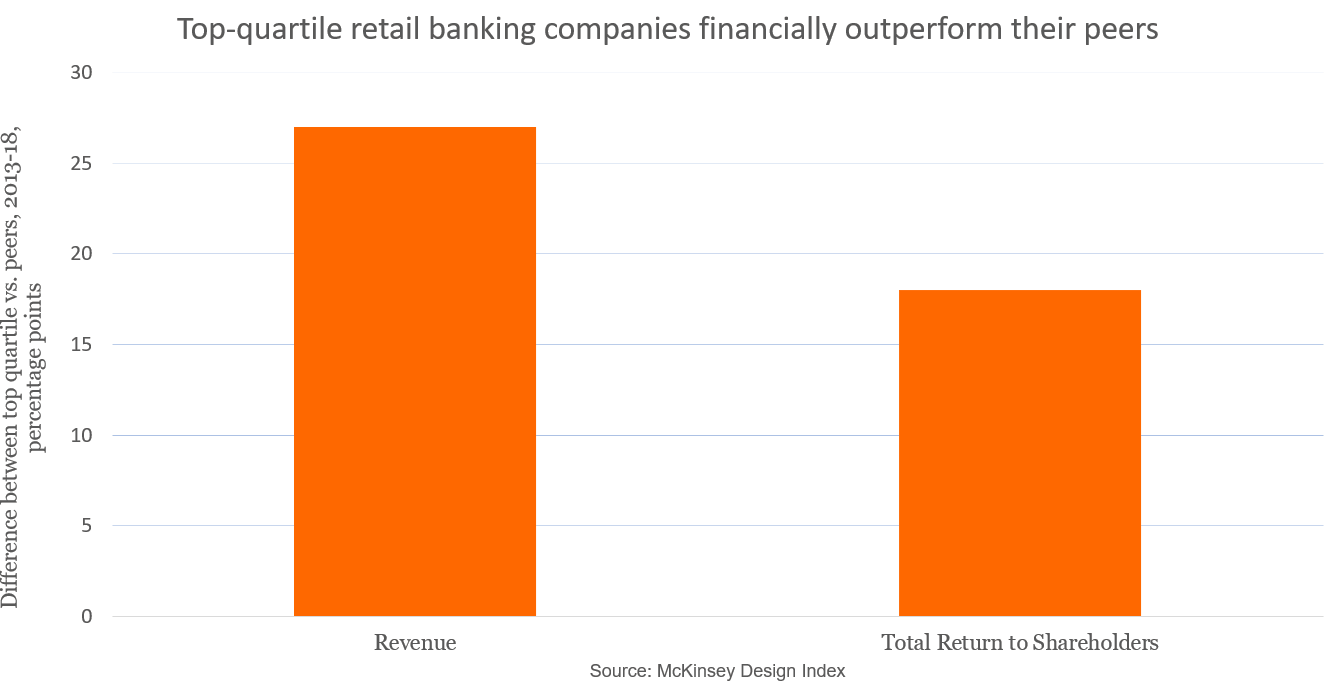

The business value of design has been well documented. McKinsey & Company found that retail banking firms that scored better on the McKinsey Design Index (an online diagnostic tool that benchmarks companies’ design maturity) earned 27 percentage points higher revenue growth and 18 percentage points greater total returns for shareholders over five years when compared to their peers.

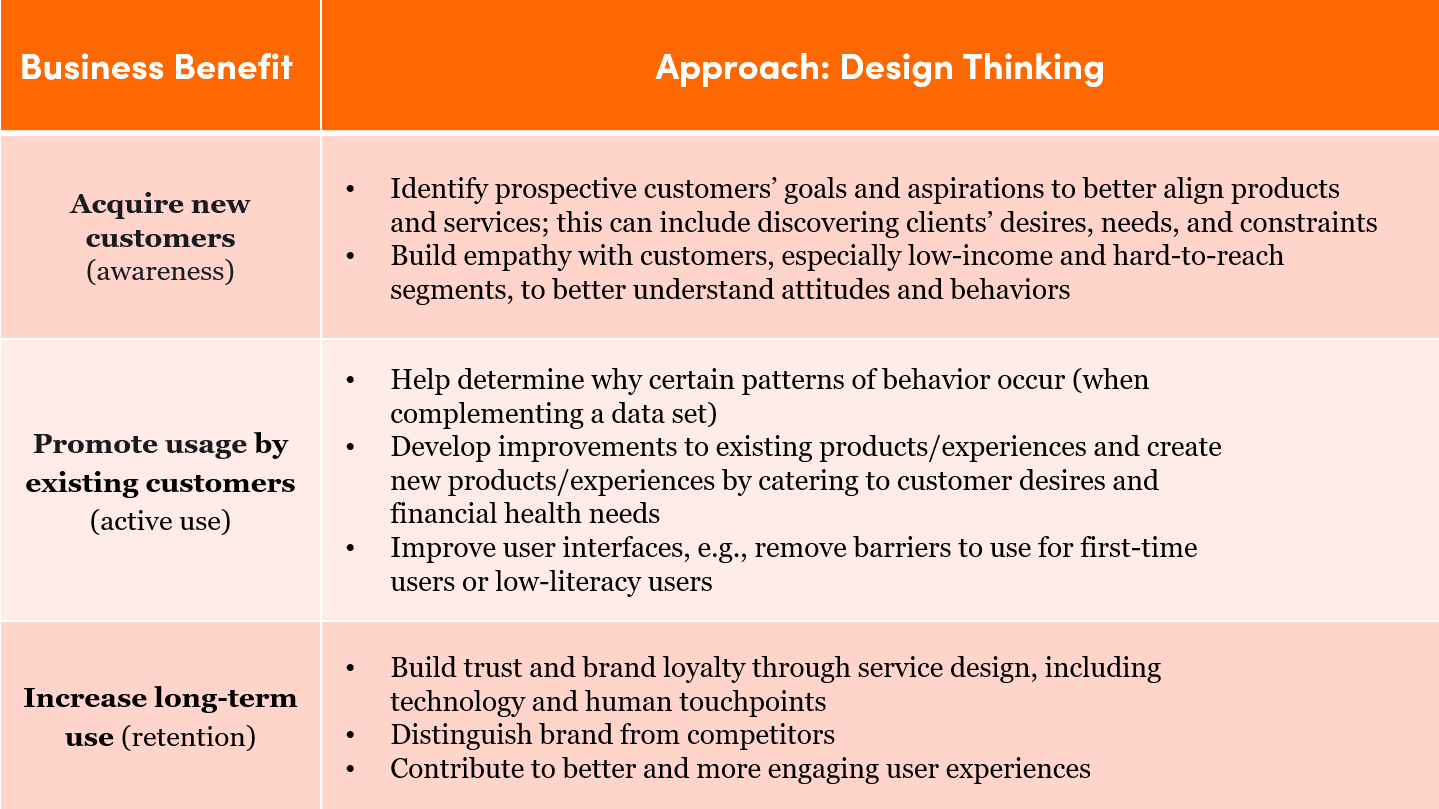

Table 3. The business case for design thinking

How can data + behavior + design help financial service providers?

Successfully using data, behavioral science, and design thinking approaches, requires a shift in business’ operations and an organization-wide adjustment. The Financial Health Network noted that orienting a business around its customers requires deploying a comprehensive strategy across the organization, one that addresses policies, processes, products, and fosters a culture that supports customers’ financial health. Furthermore, starting with the customer is just the first step. Institutions also need leaders who will stand by those insights and team members with the systematic and operational creativity to design for customer needs.

To pursue these approaches successfully, providers need to engage human-centered designers, interaction designers, behavioral scientists, and data scientists, as well as invest in field research, and conduct experiments to assess the efficacy of interventions and changes. Providers can invest internally or outsource some of these functions and expertise. Business benefits include increased customer lifetime value, enhanced reputational and brand value, larger deposit balances, decreased acquisition costs, increased loyalty and retention, and improved credit access for customers.

Businesses prosper when their customers are successful. People don’t want a bank account just to have a bank account. Instead, they use financial services that work for their purposes: to pay for their children’s education, own a home, launch a business, or recover from both economic and natural disasters. By placing financial health at the heart of the institution, using data, behavioral science, and design thinking, we can make these goals attainable for a greater number of individuals. Understanding these needs and designing for them drives financial health, advances social progress, and creates better, more successful, and more resilient businesses.

This brief is supported by the Mastercard Center for Inclusive Growth.

Contributions from: Malika Anand, John Won, Arisha Salman, Sarah Kovar, Megan Skaggs