This article is the third of a six-part series on scaling financial inclusion to accompany our digital transformation guide.

In emerging markets, many banks and financial providers rely on a network of field agents that interact with customers in person. Through in-person visits, these field agents build strong personal connections with customers while helping them to manage their money and determine which financial products best meet their needs. Many financial service providers (FSPs) who work with low-income segments struggle to build up their digital capabilities internally because their field employees fear that digital tools may diminish their deep relationships with customers and negatively impact the customer experience. Changing this mindset is key to a successful digital transformation. When FSPs can create a culture of experimentation, they can drive digital innovation and reimagine how to address challenges and opportunities that arise for their organization and their customers.

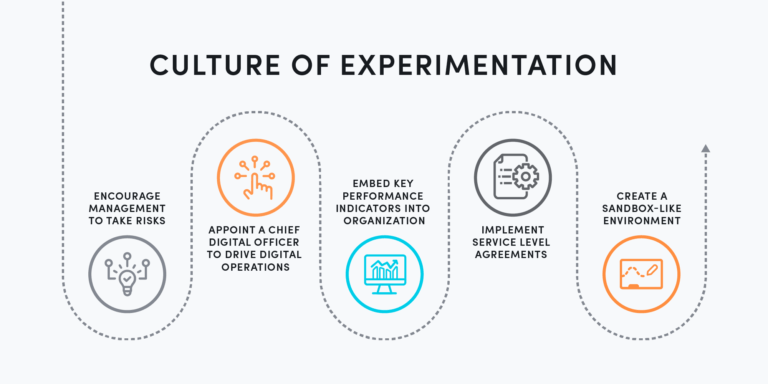

To build this culture of experimentation, financial providers should:

Focus on alignment before getting started

Many FSPs feel they need to get new products out the door quickly to demonstrate progress on digital transformation initiatives. However, providers shouldn’t shortchange the time and effort required to build alignment across the organization before taking on a new digital strategy. Successful digital transformations should start with a shared understanding of the roles and responsibilities expected of each team member — from the board of directors all the way down each level of the organization.

Sasidhar Thumuluri, CEO of Sub-K IMPACT Solutions — a partner of Accion that reaches underserved populations in India, approached the challenge of launching a new digital strategy by first aligning with all teams on organizational goals and priorities. By holding several strategy-setting workshops to identify gaps within the organizational design and process flows before developing new products, Sub-K saw an opportunity to streamline their operations. Sasidhar also appointed subcommittees to determine which activities best supported the organization’s priorities, making Sub-K much more open to running experiments that ultimately lead them to build solutions that help low-income customers in rural India.

Take a test-and-learn approach — and create a safe space to fail

When working with our partner Accion Microfinance Bank (Accion MfB) in Nigeria, we knew the organization was just starting their digital transformation journey. While the leadership team was excited and motivated to digitize, we quickly learned that other departments essential to the digital team’s effectiveness, like HR, IT, marketing, and risk, weren’t fully sold on the idea. Their KPIs remained aligned with business as usual, so they weren’t incentivized to take risks and work toward the bank’s new digital ambitions. This trickle-down approach was insufficient to cultivate a culture where all teams embrace large-scale digital changes, and operational departments support the digital team’s needs using a test-and-learn approach. To address these challenges, Accion MfB embedded organization-wide changes, including:

- Encouraging management to take risks. Since management worried about the impact of failed projects on the bank’s profitability, the board approved an innovation budget, noting that they would not count any losses against profitability metrics or performance-related pay. This change made management increasingly comfortable with learning by doing.

- Prioritizing a Chief Digital Officer with the necessary people skills to drive digital adoption. The bank’s new Chief Digital Officer set a vision and evangelized digital transformation, encouraging his team to take risks and learn from failure.

- Developing and embedding digital KPIs into the organization’s DNA. Helping all teams understand their role in supporting digital initiatives is key. For example, HR took on KPIs like the speed of recruiting talent with digital skills, while the commercial team and branch managers contributed 15 to 20 percent of their time to digital support.

“In order to ensure that the digital unit is not just a brand within a brand, we had to create a connection between departments like audit, risk, and HR. We created a digital KPI for everybody across the bank so there is ownership and an embracing of our digital strategy.”

— Taiwo Joda, Managing Director and CEO, Accion Microfinance Bank in Nigeria

- Implementing interdepartmental service level agreements. Accion MfB ensured that audit and compliance departments would conduct timely assessments of digitally enabled products, marketing would respond to new products’ needs, and risk teams would support new product innovation, all of whom created budgets and plans that support experimentation requirements.

- Creating a safe space to fail and encouraging experimentation in a sandbox-like environment. Taking a flexible approach, Accion MfB ringfenced potential risks by limiting the number of customers and the total amount to lend during the digital loan pilot so they could identify the upfront costs needed for the experiment to achieve its objectives. Providing the digital unit with autonomy and decision-making power allowed them to frame their new digital loan as a low-risk experiment rather than a fully-fledged product launch.

Combine comfort with radical experimentation

To succeed in a digital world, FSPs need the flexibility to experiment safely and effectively. Leadership teams can cultivate a safe space and offer teams the freedom to fail by mastering six skills: be approachable, show compassion, stay composed, manage conflict, direct others, and listen proactively. When leaders embody these characteristics, their teams are more empowered to develop innovative solutions to serve financially excluded populations.

Accion worked with CÍVICO, a digital ecosystem that geolocates small merchants and corner stores across Latin America to make it easier for people to find what they need in their neighborhoods. While CÍVICO is not a traditional financial provider, they saw the opportunity to serve their customers better and grow their business by providing financial services. Though they initially sought to form partnerships with external vendors to develop a digital lending platform, their users’ urgent financing needs during the COVID-19 pandemic led CÍVICO to make the bold decision to start lending directly. They launched a low-fidelity product, lending very small amounts while conducting tests, learning quickly, and making adjustments to the process. Using surveys, they were able to better understand entrepreneurs’ behaviors, biggest pain points, and state of financial health, ultimately helping to identify the merchants most in need of just-in-time credit.

Realizing the transformative power of experimentation is a commitment. Over time, these experiments can yield thousands of small and not-so-small changes that can lead to huge benefits for customers. While many experiments may fail, prioritizing innovation leads to a successful digital transformation.

Malavika Krishnan contributed to this article.