In the past 18 months, women have been disproportionately impacted by the many challenges brought on by the COVID-19 pandemic, including limited access to venture funding. The already significant disparity in global venture capital flowing to women-founded companies became starker during the pandemic, dropping from 13 percent of total venture dollars in 2019 down to 11 percent in 2020, according to Crunchbase’s latest data. While many different factors impact these numbers, we believe the solution is clear: we need to fund and support more women founders.

Helping to close these gaps is a strategic priority for our team at Accion Venture Lab. As a women-led fund with a majority women team, we’re focusing our efforts on both the leadership and workforce level of our gender lens investing strategy. As one of the first externally facing initiatives of this strategy, Accion Venture Lab hosted four workshops targeting early-stage women fintech founders across Latin America, Africa, and India. Our goals for these workshops were fourfold:

- Connect the founders to high-quality venture investors in our network.

- Foster community between the founders by creating a space for peer learning.

- Provide direct feedback and guidance to founders to help them more effectively communicate about their company and adjust their diligence process for our remote reality.

- Identify how we and the broader VC industry can better support women founders by hearing firsthand from founders about the barriers they face.

Many women founders who participated reinforced one core discovery of research into the funding gap: there is no shortage of capable women building and leading early-stage companies. We’re pleased to highlight them below and cover some of the ways we, as investors, can begin to break down the systemic barriers perpetuating the funding gap. To accomplish this, we must take intentional steps to diversify our investment opportunities and prioritize funding and supporting women founders.

Four ways to diversify your pipeline and fund more women founders

Through our work with early-stage startups, we’ve learned about the persistent barriers that women founders face. As we heard about these challenges directly from the founders participating in our workshops, we were reminded of the work that still needs to be done, and how investors like us must reflect on the ways that our own practices can be improved to create more equitable opportunities for women founders. These conversations reinforced the need to:

- Expand your sourcing network (and diversify your team) to identify more women founders – When investors rely on their established networks and relationships to search for new talent, their pipeline and portfolio will continue to look as they always have. To change the status quo, ensure you’re hiring diverse talent — at all levels — to broaden your funds’ network and drive more equitable screening processes. By intentionally building relationships with the ever-growing list of awesome women-focused funds, accelerators, and entrepreneurship hubs, you can expand your pipeline.

- Clearly state your investment focus and criteria – The venture ecosystem can be difficult to learn and navigate, especially for first-time founders. Many founders we spoke to felt they lost valuable time networking with and pitching to investors who weren’t a fit for their company. A simple fix such as clearly stating your investment focus, stage, and traction requirements on your website can go a long way toward helping newcomers navigate the investment ecosystem. More transparency may even incentivize founders who could be a great fit but are outside of your network to reach out.

- Check your own conscious and unconscious biases – Many of us have read articles that prove investors ask men and women founders different questions or engage differently with their pitch decks, but how many of us have stopped to consider and identify these patterns in our own methods? Pay attention to what you’re asking different founders and consider standardizing your diligence questions and processes. Write down key questions before a pitch call to give yourself a chance to catch potential biases before they impact your decision-making and lead to a missed opportunity.

- Commit to keeping these founders in the ecosystem – Women founders have smaller networks to tap into for investor introductions than their male counterparts. And, as discussed above, they face biases when they finally schedule those meetings. If a company is not a fit for your fund, take the extra minute to forward the deck along to investors who may be interested. By facilitating warm introductions to potential investors, we can help more women succeed in their fundraising efforts.

As we strive to create a more inclusive investment environment, these simple shifts can help our industry open more well-deserved opportunities for women in fintech, including the many women founders we’ve met from all over the world.

Meet the founders

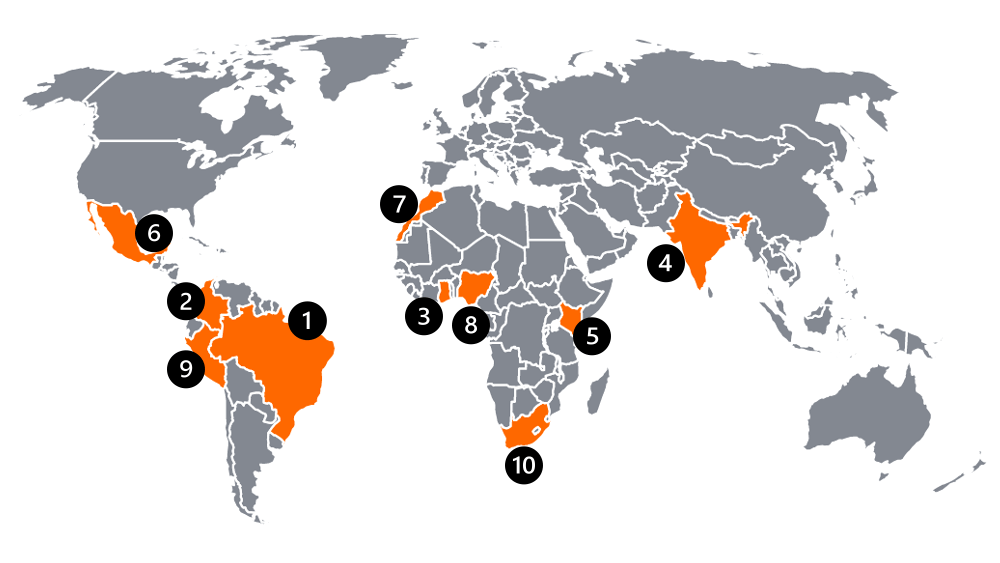

In our efforts to reach more women, we’ve engaged 38 women founders from 11 countries across 18 hours of workshops so far. We facilitated 114 one-on-one investor pitches and connected with dozens of other investors, accelerators, and founders to identify and invite promising founders to join the sessions.

We’re pleased to highlight them here:

1. BrazilRafaela Cavalcanti, CloQ 2. ColombiaVictoria Blanco Alegría, ábaco 3. GhanaMeghan McCormick, OZÉ 4. IndiaShweta Aprameya, ARTH | 5. KenyaAnnabel Angwenyi, Kazi 6. MexicoEmma Sánchez Andrade Smith, Jefa 7. MoroccoSophia Alj, Chari.co 8. NigeriaKeturah Ovio, Limestart 9. PeruCynthia Villar, MiBolsillo 10. South AfricaNicky Swartz, Spoon Money |

The diversity and inclusivity of the venture ecosystem will not change unless we put in the effort to make it happen. It’s about time we invest in women founders with our time, our resources, and most importantly, our capital. There is no one-size-fits-all approach to gender lens investing, and we believe efforts must be made across multiple levels — from the founder level to fund leadership — to create change. Accion Venture Lab is thankful for the support of the S&P Global Foundation and the Mastercard Foundation in our work to reach more women fintech founders. We’d also like to thank each of the participating investors who dedicated their time to meeting and coaching these impressive founders:

Aavishkar, Acuity Ventures, Addem Capital, Adobe Capital, Alitheia Capital, ALLVP, Angel Ventures, Asha Impact, BFA Global, Blume Ventures, Brixton Ventures Lab, Capital Lab Ventures, Chrysalis Capital, Endiya Partners, Flourish Ventures, Future Africa, Global Founders Capital, GreenHouse Capital, Jaguar Ventures, Kae Capital, Lightrock, Magma Partners, Microtraction, NXTP Ventures, Prime Venture Partners, QED Investors, Quona Capital, Startup Bootcamp, Unicorn India Ventures, VestedWorld, Vox Capital

Are you an early-stage fintech founder reaching previously underserved people and small businesses? We’d love to hear from you. And keep an eye out for more women founder workshops coming to new geographies in 2021!