John Won contributed to this article.

When people are financially healthy, they can manage their day-to-day expenses and be more resilient to shocks, like the global pandemic we’re facing now. Of course, financial health does not exist in a vacuum — a person’s financial health is inextricably linked to their physical health, the local economy, education, employment, equity, and freedom. But a person’s access, knowledge, and use of financial services also plays a role. That’s why responsible financial service providers must take financial health into account in their products and services. Beyond the social imperative, financially healthy customers are likely better customers. Even so, the industry has been not been able to provide clear direction on how to influence the financial health of customers in emerging markets.

We organized a workshop a few months ago centered around the experiences of providers who are thinking about the financial health of their customers. We convened more than 30 financial service providers, designers, consultants, and researchers to discuss how we can make the existing body of financial health research more actionable and relevant, particularly in emerging markets.

Circling up around provider perspectives

During one panel, U.S.-based providers shared how they operate in a market where access to financial services is high and where financial health has become an industry mantra. Panelists discussed how fintech trends in microcredit, earned-wage access, and gig-economy jobs have become popular. While these trends offer more credit choices to U.S. customers, they come with questions and concerns for people’s long-term financial health. There are fewer innovations in the retirement, insurance, and emergency savings space, partly because of the upfront cost of providing such products.

In a second panel, providers focused on emerging markets discussed how many low-income people are seeing a dizzying pace of change, from economic shifts like rising income levels to disruptions in livelihoods due to climate change and gig work. There’s a massive need for businesses focused on financial health. A pay-as-you-go solar provider shared how they’re often the first financial service provider a rural, low-income customer engages within, so they feel that they have an enormous responsibility to instill positive financial habits. A global provider shared how a regulatory change meant they could no longer operate in a country they once served, leaving small merchants cut off from a service they’d come to rely upon. Panelists discussed how regulation and policy can play a powerful role in advancing financial health or stymying innovation. And in markets where serving customers that have been left out can be much more challenging and expensive, the business case of offering customer-centric financial services, much less promoting financial health, is much harder to prove out for for-profit providers.

From insights to action

At the end of the day, we worked in small groups to develop actionable and realistic solutions to broader questions that many providers have when they think about financial health. These included, “How do we redefine the value of financial health within business models and design for customer growth?” and “How can we develop products that result in less financially stressed and more resilient customers?” One team suggested that by encouraging businesses to consider long-term measures, such as customer lifetime value, rather than short-term measures, such as sales, this would generate an incentive to develop measurements focused on financial health. Another team took a more macro-approach suggesting the development of an industry challenge to identify and reward a champion that could help to develop a documented business case for a financial health-focused company.

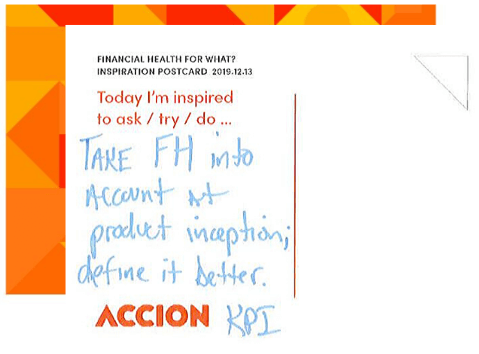

We closed out by asking attendees to reflect on the day and any commitments they’re inspired to take forward. Several attendees expressed intent to better apply or integrate measurement and tracking of financial health metrics. Other attendees noted they would initiate more research activities, conduct a public-facing discussion, integrate financial health into the business model, and make improvements to product design. All attendees agreed that financial inclusion should be measured by more than number of accounts and dormancy rates, we should be working towards our true goal — improving people’s lives.

After a full day of engaging with providers, practitioners, and thought leaders in financial inclusion, we saw progress in making financial health better understood and more actionable for emerging market providers. Lines of communication opened among practitioners who had never collaborated before, and we saw a surge of interest in sharing learnings between the U.S. market and emerging markets. While there is early evidence of a business case for financial health, the day underscored the importance of continued studies to measure and track customer outcomes and better understand the linkages between financially healthy customers and business outcomes.

We look forward to continuing to contribute to this conversation. As we continue to focus on how inclusive finance can build resilience, the Accion Global Advisory Solutions team will share learnings from the experience of our many partners and show how providers can use data, design, and an understanding of behavior to implement financial health principles into their organizational culture and product design. As we face the tremendous financial health impact of the COVID-19 outbreak and its economic fallout, this work will be critical to help the most vulnerable customers build a more secure future.