Between health risks and job losses, lockdowns and moratoria, unstable markets and general uncertainty about the state of the world, 2020 is a challenging year for startups to plan for the future. An unpredictable investment climate has also led startups to focus on extending their runway, particularly as deal activity for early-stage companies has slowed.

So how, in the midst of this challenging time, do inclusive startups find paths for growth so they can continue to reach financially underserved people? In Accion Venture Lab’s latest insights paper, Win from within, we explore how inclusive fintech startups achieve growth not through costly and unsustainable customer acquisition, but by creating value for their existing users.

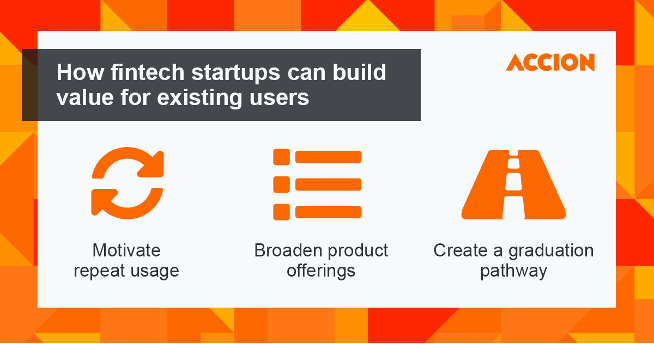

Through case studies from Accion Venture Lab portfolio companies, the paper outlines three core strategies:

- Improving user experience with features that encourage frequent and in-depth use of products and services.

- Deeping understanding of customers to craft a suite of products that addresses their pain points and fulfills more of their needs.

- Boosting value for users by sweetening their terms over time so that they stay engaged.

To execute each of these strategies, startups must stay closely attuned to their users’ needs and experiences and apply that knowledge to develop products that make life easier for their customers.

From day one, companies should think about how to continue expanding the value they bring to existing customers long-term. Growing value requires a client-centric approach to product design: constantly listening to feedback from customers, improving offerings, and testing and learning different solutions to drive engagement and retention. As the companies profiled in our paper learned, some solutions may work better than others — another reason why thinking about this from the very beginning is critical.

As impact investors, we believe this alternate approach to “growth at any cost” is crucial not only for the commercial success of our startups, but for driving greater impact in the lives of customers we hope to serve. Especially now, customers need support to rebuild, access new opportunities, and better manage their daily lives. By listening to and answering their existing clients’ needs, startups can build innovative solutions to address their challenges.

We’d love to hear your feedback on our paper – please write to us at accionvlab@accion.org. To dive deeper into how startups are driving growth by meeting the needs of their existing customers, we’re featuring interviews with the CEOs of fintechs included in our paper in a special four-part miniseries of Accion Venture Lab’s podcast, VentureKast. Subscribe to VentureKast on Apple Podcasts, Spotify, and SoundCloud to catch the new series.