What if billions of people could access low-cost financial transactions without the need to work through an intermediary like a bank or brokerage? This is the basic idea of decentralized finance, or DeFi, a fast-growing subsector of the broader, decentralized version of the internet – web3.

Many advocates believe that web3 can be the driving force behind a more inclusive financial system. After all, 1.8 billion people still aren’t being served well — or at all — by the global financial system, as we discovered from the 2021 Global Findex.

At Accion Venture Lab, we are continuously exploring the potential of new applications of technology focused on empowering low-income and traditionally underserved communities around the globe. At the same time, we keep a close eye on whether we can avoid negative externalities from taking root in already vulnerable communities. In the case of web3, the industry is rapidly evolving, and we are aware of the complexity of establishing formal standards or models of accountability and governance for web3 projects to mitigate potential risks to the end customer.

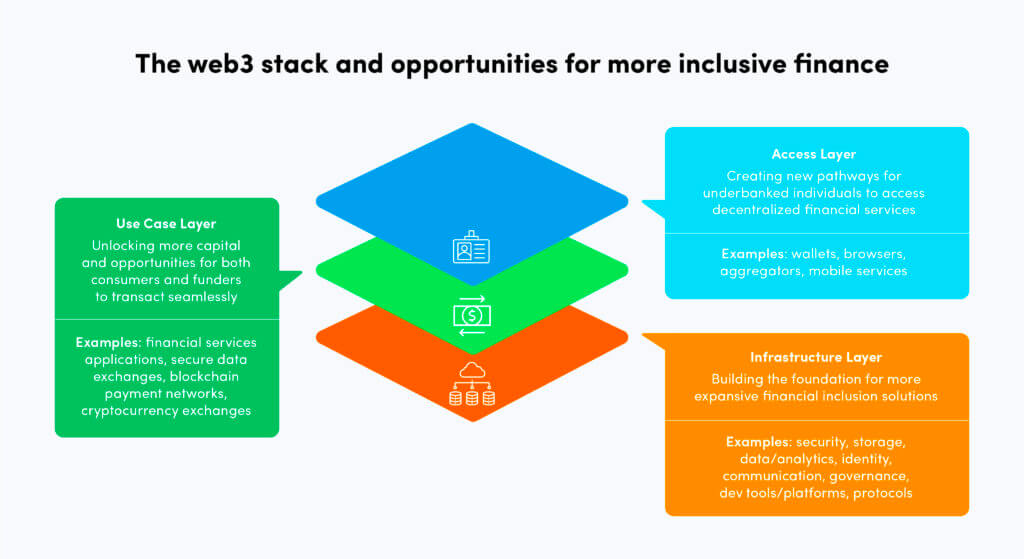

From an investment perspective, there are also many layers of web3 to consider funding in order to build a more comprehensive ecosystem. Coinbase did an excellent job summarizing these layers in this guide to the web3 stack, and it inspired us to think about how we can gain a clearer picture of its inclusive potential and build on this understanding to make a real and meaningful difference in the lives of underserved people.

Overview of the web3 stack

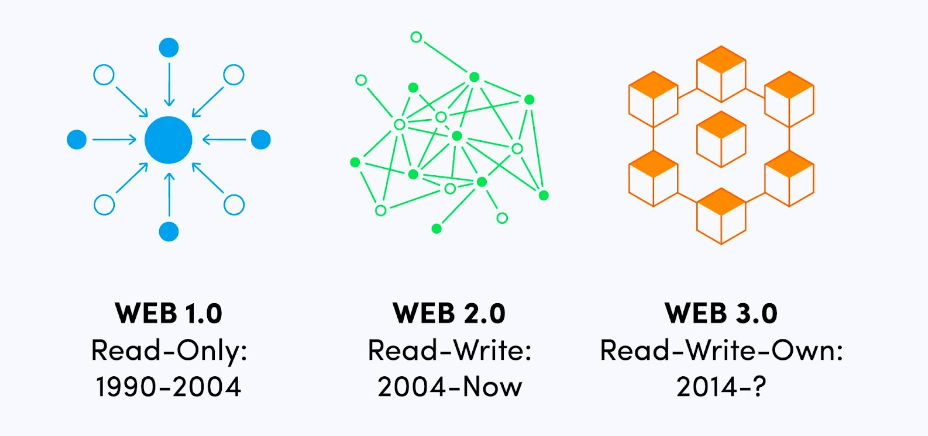

Web3 in itself is a loaded term, but two components are usually standard: it leverages (1) blockchain technology and (2) token-based economics to offer a somewhat decentralized form of the internet. In theory, everyone has equal access to participate.

The decentralized nature of web3 infrastructure also holds a lot of promise for eliminating intermediaries. New platforms are creating seamless connections between different layers of networks and applications, enabling end users — which could be individuals, small businesses, or even banks — to interact with each other directly and control their own data and information. This is a substantial shift from Web2, where centralized platforms and authorities traditionally control all of this information. As the web3 space continues to grow and its use cases expand rapidly, it is helpful to categorize the emerging protocols, applications, and use cases into distinct layers.

As Coinbase outlines, the primary layers of the web3 stack include the access layer, the use case layer, and the infrastructure layer. Outlining where these layers begin and end can help us understand both the wide range of possibilities and limitations of web3 to create a more inclusive financial system, as well as where investors and builders alike should focus their energy.

1. Infrastructure Layer

Similar to how cloud and data centers form the digital infrastructure of the internet today, we can think of the infrastructure layer as the “building blocks” of web3. The infrastructure layer includes all of the tools and services to build and deploy decentralized applications at scale.

A good example of how infrastructure technology can help central banks modernize their operations for financial inclusion and resilience is EMTECH. The startup designs and builds customized digital currency-based solutions for banks in emerging markets. Following a successful pilot in Ghana, EMTECH is already working with more central banks in Africa and the Caribbean.

We will want to keep an eye on how these various frameworks evolve in the upcoming years. Not only will there be various purposes for protocols, but having a community of software developers that can build within these protocols will be important. Particular protocols like Celo are already positioning themselves as creating communities more oriented toward responsible applications of web3 technology.

2. Use case layer

We think of the use case layer as the “user interface” for interacting with applications built on blockchain technology. Decentralized applications (or “dApps”), financial applications, loan contracts, and even NFTs all serve as a bridge for users to interact with various blockchains.

Most business models adhere to the core principles of web3, which encourage them to be permissionless, trustless, and support native payments. These user-friendly interfaces, coupled with a lack of intermediaries, create enormous potential for more unbanked and underbanked people to access financial services and control them completely. For example, Accion Venture Lab portfolio company Pula, which recently joined the Lemonade Crypto Climate Coalition, is applying smart contracts to automate crop insurance processes and calculate payouts for smallholder farmers in Africa and Asia.

By cutting out the intermediaries, the costs of financial services are also drastically lower. Additionally, consumers can leverage their digital assets to increase their ability to secure credit, protect themselves financially during unstable economic times, and much more.

The benefits of a web3-enabled use case layer are, ironically, also some of its greatest risks. End customers may not be aware of an exchange of underlying assets on the layer. Additionally, as we saw with the Tether and Celsius networks, securitizing transactions with a speculative asset could cause substantial negative effects to an individual with limited awareness. We will speak later in this article about some of the regulatory gaps that need to be filled. However, the use case layer may benefit the most from proper governance.

3. Access layer

There is still a steep learning curve to web3 adoption for a large swath of the world. It often requires a certain level of disposable income, digital awareness, and technical expertise to start engaging with web3 technologies – and for the financially excluded, a rudimentary understanding of how to engage with digital financial services is not always guaranteed. However, many tools and applications are emerging that make it more accessible to everyone.

In emerging markets, mobile wallets are becoming increasingly common for easily buying, selling, and converting both fiat and cryptocurrencies. For example, Congo-based startup Jambo is building Africa’s web3 user acquisition portal by democratizing access to crypto-based income generation opportunities. Crypto exchanges such as Valr in South Africa and Busha in Nigeria are working to onboard millions of individuals to the digital economy.

Aggregator platforms are also helping those who are new to cryptocurrencies and digital assets monitor their activities across various applications. Some examples of these platforms include DefiLlama and DappRadar. Web2 platforms, like Twitter and Discord, are also playing important roles in breaking down barriers to web3 and making it more approachable to the masses. These platforms are introducing integrations with digital wallets, exchanges, and even token-based loyalty programs.

However, we are still seeing a gap in the ability to deliver these technologies to a large swath of financially excluded individuals – and given our observations regarding the need to build trust face-to-face, web3 technologies could exacerbate this issue.

Regulatory considerations

For all of the exciting possibilities web3 offers, there are still limitations and plenty of reasons for skepticism. Cryptocurrencies, which play a crucial role in web3 transactions and experiences, are inherently speculative and volatile (including stablecoins). Mining them can have severe climate implications, and they create countless threats to consumer protection. Plenty of investment schemes posing as fun games can also do more harm than good, especially in emerging economies where early adoption is often the greatest. The economic disaster in El Salvador following the adoption of Bitcoin as legal tender also shows the risks of adopting crypto in the hopes of fostering inclusion and reducing poverty.

Web3 is developing extremely fast, and there are many issues that any project promising positive social impact must address. The Stanford Social Innovation Review defined a few of these key challenges as:

- Creating equitable power structures – A key selling point of web3 technologies is decentralization, or shared ownership of web infrastructure. However, a small minority of participants are still at the top of many web3 token-based economies — for example, corporations and people who already have the wealth and resources to take the lead. Uneven, centralized power structures can quickly become the norm if plans for equitable ownership are not in place from the beginning of a project.

- Exploitive business models – A major concern of blockchain technology is its impact on our climate, environment, and energy-poor communities. Companies building in web3 can no longer avoid these issues in their business models. They must address any environmental impact in an appropriate, credible way in order to build trust with their communities, customers, and other important stakeholders.

- Avoiding abuse in communities – There are inherent risks to building decentralized communities. Bad actors can take advantage of the promises of anonymity and immutability to harass and abuse other members, especially when there are no systems of accountability or protection against such threats.

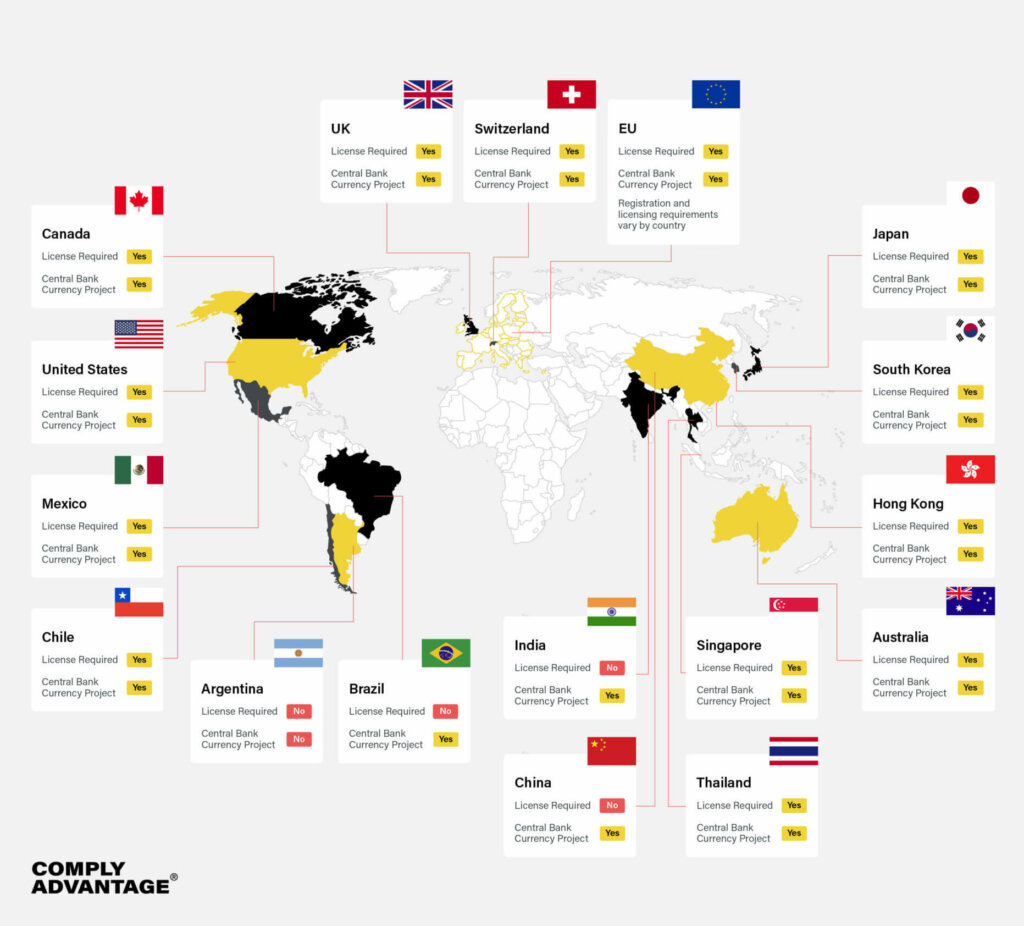

There are also significant regulations and compliance requirements to monitor as well. More and more governments and regulatory institutions are stepping up oversight and introducing new laws surrounding consumer protection, data privacy, and KYC/AML.

Crypto regulations around the world

It is important to apply the lessons we’ve already gained from the digital revolution and the immense challenges of the pandemic, to protect consumers as web3 and DeFi innovations take root. The Center for Financial Inclusion is already starting this work by convening the Responsible Finance Forum and Financial Inclusion Week, where fintech leaders, regulators, investors, researchers, and beyond can share the latest insights on cryptocurrency, blockchain, and their implications on consumer protection.

Regulatory technology, or regtech, can also equip both innovators and regulators with faster, more powerful tools to strengthen compliance for new technologies and anticipate new risks that require new or adapted regulations.

We also need expanded evaluation capacity and transparency among fintech companies in this space. Investors should hold their portfolio companies accountable for their claims about inclusion and encourage companies to better evaluate their impact on clients’ financial well-being. It’s also crucial to integrate this accountability and transparency into the due-diligence process and when engaging with portfolio companies.

New pathways for financial inclusion

At Accion Venture Lab, we are cautiously excited to continue exploring web3 and the many possibilities across payments, savings, credit, insurance, and more. By testing, investigating, and growing DeFi use cases for underserved clients, we can gain a clearer picture of its inclusive potential and build on this understanding to make a real, meaningful difference in the lives of low-income people.

However, we also encourage our fellow investors in the financial inclusion space to take a “customer first” perspective on potential investments. We are witnessing the creation of many emerging technologies simply due to a sizable war chest with little regard for potential implications on the end customer. We risk placing innovation above responsibility, and now is the time to set appropriate standards on how to evaluate these technologies from both an investment and customer impact lens.

Follow our journey and learn more about web3 by tuning into our Fintech for the People podcast’s third season, where we discuss all things web3, crypto, and financial inclusion with a variety of participants in this space.