Rajalakshmi, a 30-year-old entrepreneur, runs a tailoring business from her home in Rajanagaram, a small village in the state of Andhra Pradesh, India. She owns a feature phone and occasionally uses her husband’s smartphone to make calls and watch videos. While she has observed her husband making digital payments from his phone, her fear of making mistakes prevents her from trying it herself. However, she knows the risks of keeping cash at home and acknowledges the convenience of digital payments both in her personal life and for her business. Rajalakshmi’s experience reflects a common dilemma faced by rural women in India, who display moderate comfort with digital tools but are yet to fully harness their potential for financial empowerment.

Despite the progress of rural India’s digital revolution, stories like Rajalakshmi’s serve as a reminder of the existing disparities. As of August 2023, over 500 million Jan Dhan accounts have been opened under the government’s Pradhan Mantri Jan Dhan Yojana (PMJDY) program, reflecting significant progress. The PMJDY has facilitated one of the most substantial financial inclusion initiatives in the nation, with 66.8 percent of accounts launched in rural and semi-urban areas and 33.2 percent in urban communities under the scheme. However, the World Bank’s 2021 Findex report indicates that while 78 percent of Indian adults have formal bank accounts, only 13 percent have borrowed from a formal financial institution. This disparity is more pronounced in rural areas, where a mere 30 percent make digital payments.

Though various government-led initiatives have promoted digital payments — from the BHIM mobile app to Aadhaar (national ID)-enabled payment systems and others — uptake and usage of digital financial services remain very low. This is especially true among low-income, rural, and women customers who have limited access to mobile phones and lack affordable and reliable internet access. Along with trust and confidence, there is a need to build their payment behavior. Accion, in collaboration with HSBC India, is working with two large microfinance institutions, Satin Creditcare and Fincare Small Finance Bank, to address these challenges and drive digital payment adoption among low-income women in rural India.

We conducted human-centered design research to understand the core challenges of using and adopting digital financial products. We used carefully curated visual tools and cue cards to spark conversations and stories with 61 women customers and 36 staff members across Uttar Pradesh, Bihar, Karnataka, Andhra Pradesh, and Telangana. Our primary objective was to gain insights into the motivations and barriers faced by both customers and field staff, specifically focusing on digital loan repayments. We also tested early-stage solutions for increasing uptake, which included gathering feedback on Accion’s new capacity building program and on UPI 123PAY, a new interactive voice response (IVR)-based payment system for feature phone users that can be used without internet.

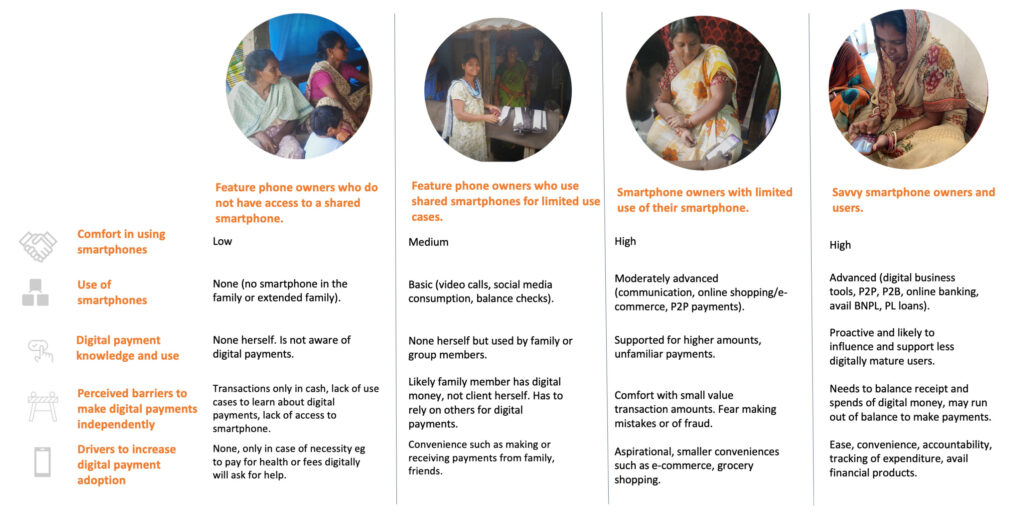

We then used Accion’s proprietary Digital Maturity Assessment tool to evaluate the digital maturities and archetypes of the women who participated in our research. This tool evaluates digital maturity across four critical dimensions: digital readiness, financial and business readiness, micro enablers, and macro enablers. These dimensions inform archetypes based on low, medium, and high digital maturity.

Digital customer archetypes

Our research unveiled primary barriers — such as lack of access to smartphones, insufficient knowledge on making digital transactions, and fear of digital fraud — and crucial enablers for users across archetypes to embrace digital loan repayments. These enablers include guidance from peers and family members, emphasizing the pivotal role of social support in enhancing women customers’ digital proficiency. Additionally, well-trained and committed staff play a significant part by providing support and resolving concerns, effectively encouraging the use of digital tools. The presence of a robust digital infrastructure within an institution is crucial to ensuring seamless delivery of well-designed products through diverse channels.

Based on our research findings, Accion is taking a multifaceted approach to drive digital payment adoption in collaboration with our partners. This includes a new program designed to provide microfinance customers with the knowledge and skills necessary to navigate digital financial tools effectively. The Digital Financial Capability program aims to build customers’ confidence and proficiency in making digital payments, thereby enhancing their access to financial services, and ultimately nurturing financial independence.

Our approach also includes a strong emphasis on ensuring that microfinance field staff receive comprehensive training, equipping them with the necessary expertise to guide and support customers in their digital payment journey. This training is intended to improve their expertise in delivering digital financial services. There is a dedicated focus on improving grievance redressal systems, and implementing measures for more efficient grievance redressal within the institutions. The aim is to ensure a timely and thorough resolution of any concerns raised by microfinance customers.

Our journey alongside rural women like Rajalakshmi highlights the evolving landscape of the digital revolution in rural India. While significant progress has been made, disparities persist, particularly among low-income, rural women. Tailored solutions addressing their unique challenges are crucial. Through strategic initiatives and collaboration with our local partners, we are actively narrowing these gaps. The impact is tangible, with over 60,000 women customers embracing digital payments in the pilot states as of September 2023. We will continue to build from our experiences to motivate more rural women to adopt digital payments and seamlessly integrate them into the digital finance ecosystem.

Learn more about Accion Advisory and reach out if you want to learn more.