As countries have implemented lockdown measures in response to COVID-19, people have fundamentally changed how they interact with their financial service providers (FSPs). Many small business owners — already squeezed for cash and hit hard by reduced customer traffic — are unable to receive loan disbursements, make repayments, or communicate in-person with their bank or lender as they have in the past, creating immense challenges for their cash flow planning. Many institutions are helping their clients by deferring or restructuring loan payments, but these measures are only sustainable in the short run, as clients’ delayed payments and logistical problems are creating a cash crunch for the FSPs as well, particularly for those still having to make payments to their own funders.

Microentrepreneurs and small businesses around the world are struggling and need financial relief. Financial institutions must act now to build their operational resilience so they can survive in this new reality and continue serving their customers. Meeting this challenge will mean embracing digital solutions to keep in touch with clients, enable business continuity and remote work, and support digital payment channels.

Financial service providers responded quickly to keep their systems operational

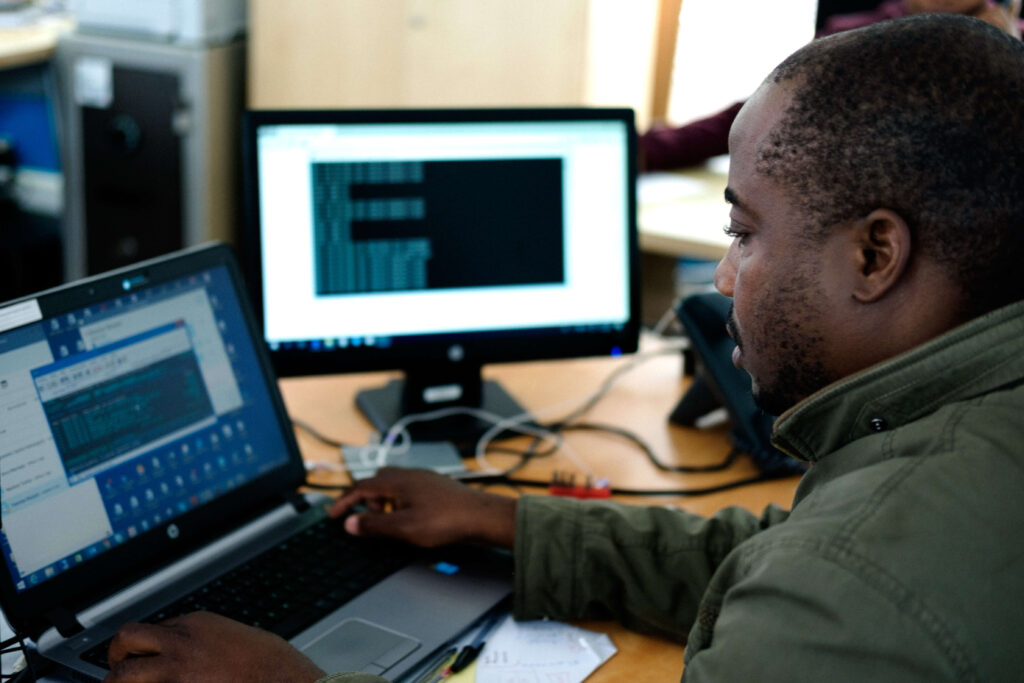

Accion has seen how financial service providers have used technology to respond to the crisis in a variety of ways. Despite limits on the mobility of their staff, FSPs have kept their IT systems running. Some were well-prepared because they already hosted their core applications with cloud providers that offer business continuity planning. To ensure staff could work remotely, some organizations had the foresight to issue laptops or tablets instead of desktops for key staff to access systems securely, and some are paying for employees’ home data services.

To support their customers, many financial institutions set up dedicated call centers and sent customized messages via SMS or messaging apps to check in on customers’ well-being and share advice and information. The Achilles’ heel of most FSPs, however, has been payments: those that offer cashless, digital channels to collect repayments and disburse loans have kept payments flowing to and from some clients. However, those that require clients to pay loan officers in person, or whose regulators have declared a moratorium on debt repayments, have largely ground to a halt.

Four steps for FSPs to accelerate digital financial solutions

Behaviors will change in fundamental and unpredictable ways before this crisis is over. Attitudes and regulations against face-to-face encounters may not relax fully until whole populations are vaccinated — which is still at least a year away, likely longer. Some clients may not want to meet face-to-face at all in the future, which could trigger all providers to pivot to new business models.

FSPs need to take the following steps to serve clients in this new normal:

- Urgently prioritize opening digital channels for clients to make loan payments and receive disbursements with minimal in-person interaction. Depending on the country, such channels may be based on partnerships with payment networks, mobile telecoms operators, or the post office, so FSPs will need to overcome any fear of partnering with providers who would gain access to their clients.

- Upgrade digital communications channels to engage and support clients remotely through better use of messaging tools like WhatsApp, more effective social media, stronger contact centers, and better customer relationship management (CRM) practices. The gatherings that have long been a pillar of group lending may need to shift to video conferences for group members and loan officers. Group lending providers who shift meetings to video must take care to maintain the benefits offered by group meetings, which have allowed members to resolve problems with repayments, support each other’s businesses, and build leadership skills and community. Eventually, the entire lending journey, from introduction to disbursement to renewal, could be conducted online for some clients.

- Embrace a larger role for data as in-person assessment has become more difficult. Graded credit assessment, where well-performing, long-term customers may be reviewed for renewal without in-person contact, will now be more compelling for some products. If FSPs are to use data to facilitate the customer journey, they will need to ensure robust data quality, infrastructure, and algorithms.

- Do not lose sight of the importance of cybersecurity when opening access for remote users and moving forward with digital solutions. Businesses that are already stretched by the crisis could be crippled by hackers, ransomware, or theft of customer data, so institutions cannot cut corners on their cyber strategy.

A silver lining of COVID-19 may be that the pandemic will accelerate financial inclusion, as digital transformation improves financial services, efficiency, and interest rates and increases access to new payment mechanisms or even bank accounts. The transition will be as wrenching for many providers as it will be for their clients, so Accion stands ready to advise and assist them as they adapt to the new normal.