Karen is a single mom who lives in Santiago, Chile, with her young daughter. She went to school to study business administration but had to drop out to care for her daughter. Today, she works at a retail shop where she makes just enough to get by. Karen worries all the time — about paying the bills each month, about providing for her daughter, and about her growing credit card debt. She knows she needs to make a change, but she doesn’t know where to start. She tried to put together a plan to pay off her debt, but couldn’t figure out the total amount she owed, or identify the right person to call. Thinking about money makes her feel stressed, overwhelmed, and alone.

Accion’s partner Destacame, a Chile-based personal financial management platform, sees many people like Karen, who come to their website looking for a way to get out of debt, access their credit report, and get answers they’ve been unable to find in the formal financial sector. The pandemic has only exacerbated feelings of financial insecurity in Chile. Destacame found that, due to COVID-19, 54 percent of their users are facing reduced or no income, 30 percent are unable to pay bills and almost all noted uncertainty and stress about their financial situation. Only 12 percent said they felt prepared for a shock like COVID-19.

Destacame knew that their users need more than just access to financial products – they need help to navigate their financial lives. This includes clearly understanding their current situation, weighing the pros and cons of the solutions available, planning to achieve goals, and receiving support and guidance along the way. As one user said, “I want to save and change my spending, but I don’t have any idea where to begin! I need an advisor — like Jiminy Cricket — who provides me with guidance and helps me to plan.”

An advisor and companion on the path to financial health

To truly support users like Karen, Accion and Destacame came up with an ambitious solution: completely redesign the Destacame experience and value proposition around financial health by adding simple diagnostics, customized user journeys, and digestible tips, tools, and product recommendations that match the user’s current reality. Beyond simply adding new products and features, the ‘Experencia Destacame’ (Destacame Experience) project involved changing the core of the platform: how it was structured, how the user interacted, and what value it sought to provide.

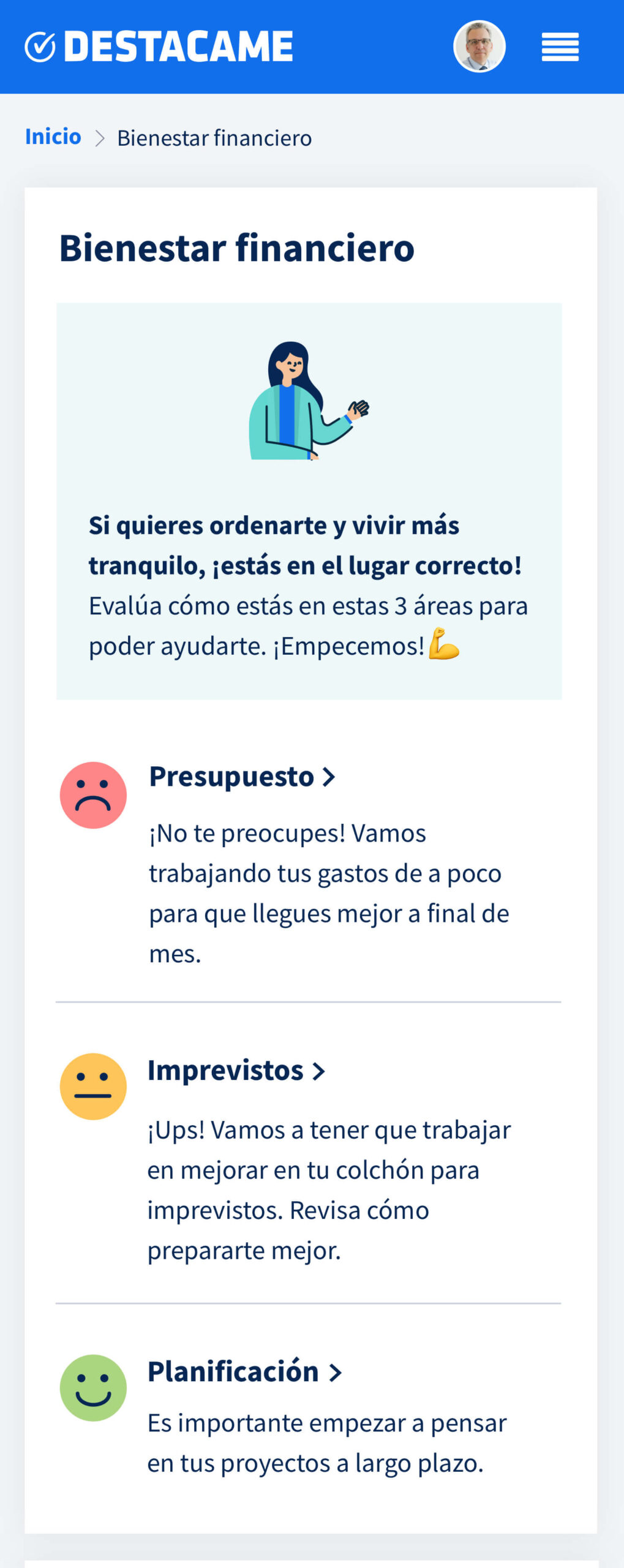

The new site design starts by clearly communicating Destacame’s customized offering to potential users and highlighting common challenges for the target user, such as, “Are you up to your neck in debt?” and “Are you stressed by your finances?” Once registered, users arrive at a personalized dashboard that assesses their financial health in three main categories: budget management, shock resilience, and long-term planning. This three-part diagnostic serves as the heart of the site redesign: based on their responses, users are directed to discrete experiences that offer the most relevant support for where they are today, including tips and recommendations, access to tools, and suggestions for financial products. The diagnostic also allows Destacame to isolate a recommended next step, encouraging users to take one first action rather than overwhelming them with a flurry of recommendations and products.

The team also developed two digital tools to support users in their journey towards financial health: a budgeting tool and an expense reduction tool. These pieces are foundational for all platform users: before saving for shocks or planning for the future, individuals must first get their budget in order and make sure their expenses don’t exceed their income. Both tools are easily accessible on mobile devices, require little time to complete, and quickly demonstrate and reward progress towards better financial habits.

The budgeting tool walks users through a series of screens to add income and expenses and calculate their savings. It helps users to consider and understand all possible expense categories and prompts users to return and update after a few months.

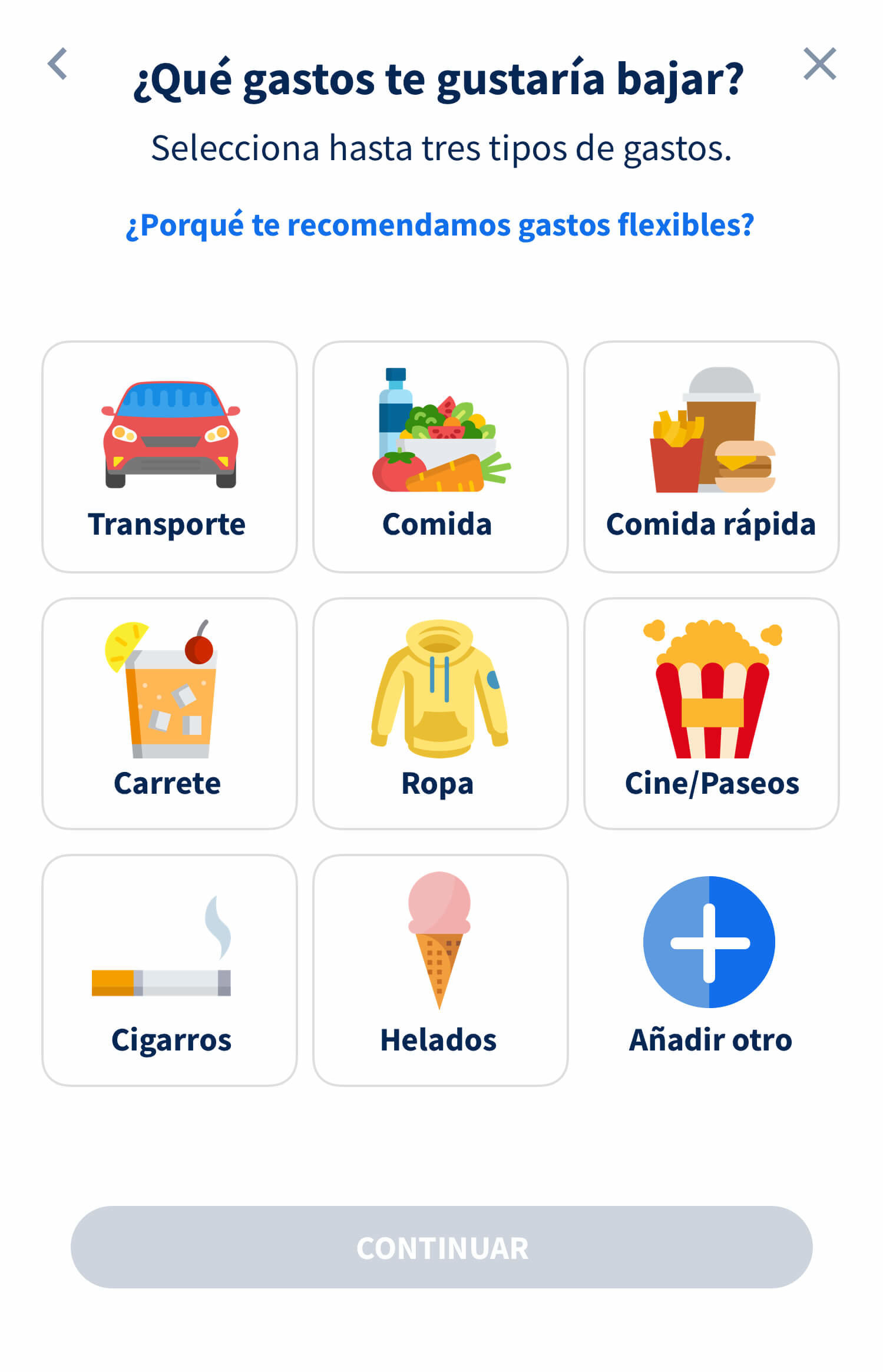

The expense reduction tool helps users to better manage their monthly cash flow by setting goals to reduce expenses in key categories, and entering spending once a week to assess progress. The tool is designed to be flexible enough to meet user needs (for example, selecting the day to receive reminders) but structured enough to encourage action, using positive language, and offering support.

Destacame recommends customers complete the tools based on their unique situation. For example, if a user is unsure that they can cover their monthly expenses, the platform will direct her to complete a budget first to gain a better understanding of her cashflow. After completing the budget, she may see that she is spending more than she’s bringing in each month and be prompted to work on reducing expenses via the expense reduction tool. After reducing expenses, she may be encouraged to start saving, and provided with recommendations for relevant savings products. Core to our hypothesis is the belief that providing users with the right tool or product at the right time is critical for uptake, usage, and impact.

Impact to date

Since launching in early 2020, almost 700,000 users in Chile and Mexico have visited the redesigned site. Almost 35,000 people have completed the diagnostic, 60,000 have accessed the budgeting tool, and 10,000 have accessed the expense reduction tool. These conversion rates are consistent with broader usage of Destacame products and impressive for self-driven tools. But perhaps more impressive is that the team is already seeing users’ financial behaviors change: since July, 35 percent of the users that completed the budget tool created a budget for the first time, 20 percent of those that accessed the expense reduction toolset a savings goal, and 17 percent of those using the expense reduction tool actually decreased their expenses.

When the pandemic hit in March 2020, Destacame saw the potential to help Chileans struggling with unemployment, debt, and uncertainty by offering a way for them to navigate their financial situation and set a plan for recovery. They launched a marketing campaign with the hashtag #CuarentenaFinanciera (financial quarantine) highlighting their new resources and encouraging users to focus on building their preparedness, resilience, and overall financial health. In response to a new law permitting pension savings withdrawal, the Destacame team launched another campaign in July called #ChileSinDeuda (Chile without debt) to encourage Chileans to use this opportunity to pay off outstanding debt, and work with their partner banks to offer discounts. Through this program, they were able to offer 3.5 million Chileans an average discount of 60 percent on their outstanding debt.

To encourage sustainable behavior change, institutions need to design for and encourage healthy financial habits that work within users’ everyday lives. While designed to be as easy-to-use as possible, Destacame’s current tools still rely heavily on user input. Users must be highly self-motivated and take the time to update tools. In 2021, Destacame plans to roll out additional products, including a new mobile application and debit card, that automate assessment and support for financial health and reduce effort for users. For example, syncing budgeting and expense management with card transactions, allowing users to set limits for certain categories and create savings wallets, and supporting future planning by projecting income and expenses.

Little by little, Destacame users are progressing on their path to financial health, supported by a more personalized approach that meets them where they are. Destacame’s focus on serving the low-income segment in Chile has also been a market differentiator and offered opportunities for further expansion and innovation. Today, Karen has finally gotten out of debt and is starting to save up towards buying a house. She’s happy with how far she’s come: “Destacame has motivated me to pay off my credit cards quickly, and I was able to get out of debt because of them.”

This product is a part of our Building Financial Capabilities and Strengthening Institutions through Customer-Centered Innovations project, supported by MetLife Foundation.