As the economic effects of the coronavirus pandemic hit cities and towns around the world, small business owners face major challenges, on both the supply and demand side, to keep their businesses running. These entrepreneurs are often risking their savings, and sometimes their health, to generate income to survive, and they need urgent support to keep going. Beyond providing essential goods and services in their communities, these businesses account for nearly half of the world’s jobs. If they collapse, global economies won’t be able to recover.

Financial service providers (FSPs) that serve low-income individuals and businesses need to act now to support families and communities. These providers must consider near-term challenges while positioning themselves for a very different future. Though we don’t know what the post-crisis world will look like, one thing is certain: given the speed at which the virus has spread and the depth of its devastation, a passive response from financial service providers is not an option. Once the immediate crisis has passed, the future viability of these institutions will depend on how quickly they can adapt to new circumstances and gain momentum that will drive efficiency and growth.

Accion Global Advisory Solutions is focused on building the resilience of financial service providers and their ability to support their clients who need their help to weather this crisis. Innovations in fintech and digital transformation will help financial service providers continue to offer needed services to their clients and remain viable themselves during these extraordinary times. We are working with our partners around the world to help them navigate the crisis so they can help their clients rebuild and relaunch their businesses.

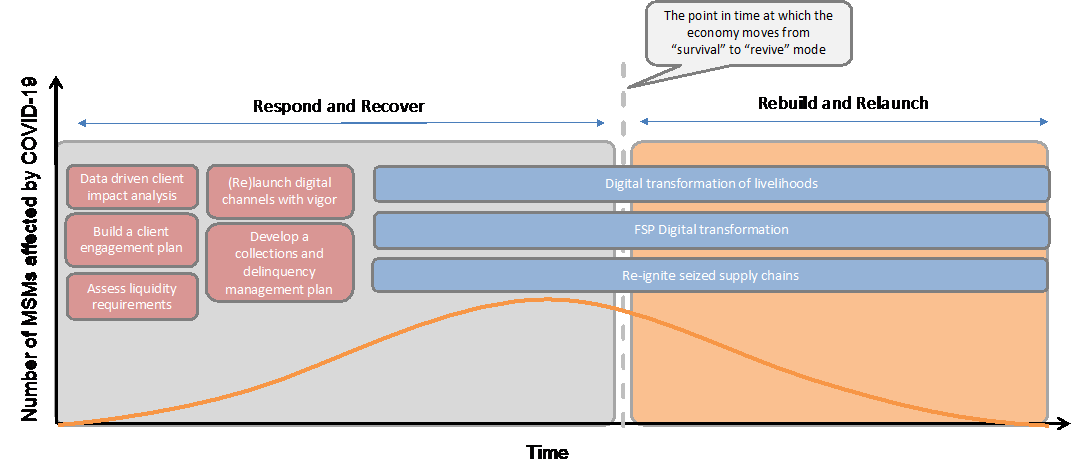

To fuel the recovery for low-income individuals and micro, small, and medium enterprises (MSMEs), we are working with our partners to:

- Conduct data-driven client impact analysis: Quarantine measures have impacted businesses and industries in different ways. Retailers selling essential items like food and toiletries have remained open, whereas hairdressers, apparel stores, and restaurants, have been forced to close and suffer losses. Because the pandemic has impacted sectors differently, it is important to be sensitive and responsive to the unique needs of clients. Data-driven client impact analysis helps FSPs respond to clients in a targeted manner — delivering relevant education, marketing messages, and innovative disbursal and collections strategies. Additionally, this analysis allows FSPs to understand how their portfolio will be impacted based on which segments of the economy they serve.

- Develop a collections and delinquency management plan: Because of their reduced income, many clients are struggling to make repayments. It is critical to develop a customer-centric collections strategy and delinquency management plan. Evidence from past crises shows that the majority of clients want to repay loans to trusted FSPs and maintain a good relationship for future financial needs. Collections management should be clearly defined and follow client protection principles.

- (Re)launch digital channels with vigor: In an environment of mandated social distancing and lockdowns, digital and alternative channels — mobile, card, ATM, internet banking, and agent networks — have become even more important as they ensure that clients can still complete transactions. FSPs need their digital channels to be stable and robust enough to handle more transactions as clients turn to digital channels to repay loans and seek other financial services. Many of these clients will need guidance and training to build comfort and trust in digital channels, especially those that are first-time users.

- Build a client engagement plan: Financial service providers should be a trusted partner to their clients. To provide immediate support, FSPs should relay important health and safety guidelines from local health authorities and share updates about their own response in a friendly and understandable way. They should also communicate information regarding loan moratoria and adjusted repayment schedules clearly and through a variety of channels. Providers can offer education, mentoring, and tools to help microbusinesses rebuild or, in some cases, pivot and start a new business while embedding best practices to build financial health and resilience.

- Assess liquidity requirements: Maintaining sufficient financial liquidity is vitally important for on-lending, operating expenses, and capital purchases. As the risk of defaults has risen, levels of portfolio-at-risk will increase. In many countries, FSPs have faced government moratoriums on client repayments, but not always been able to negotiate rescheduling their own borrowing, which exacerbates the liquidity pressures. These combined factors have triggered a more urgent need for debt liquidity from third parties, many of whom are themselves facing liquidity pressures. Developing a cohesive funder strategy is critical to an FSP’s ability to manage through such shocks.

- Embrace digital business models: The need for digitization of FSPs, to help reduce their operating cost and to support micro and small businesses remotely, is more apparent than ever. This includes the development of data-driven, technology-enabled products, channels, underwriting, and operating processes. Through digital transformation, FSPs can build business models that serve existing clients better and help new clients through remote onboarding.

- Reignite seized supply chains: Supply chains depend heavily on MSMEs, both for production and sales. These MSMEs can constitute up to half of revenues for the largest consumer goods companies. Supply chains everywhere are being impacted by decreased demand from these businesses or suppliers’ inability to complete orders. While production will require concerted efforts of supply chain anchor firms, retail sales can be sustained through greater financing flexibility for merchants and their distributors. Supply chain finance offers a realistic and short-term means of extending funds using data and technology.

- Support the digital transformation of microbusinesses: Given the massive impact this crisis is already having on the economy worldwide, there is an urgent need to reimagine how MSMEs — which account for 90 percent of businesses in emerging countries — buy, sell, and operate. As digital platforms become ever more pervasive, businesses can leverage new tools to rebuild and relaunch. One way to enable the digital transformation of small businesses is through an ecosystem approach: a marketplace for business opportunities, training for entrepreneurs to plan for the future and leverage these platforms, and the financial support to fund capital needs. E-commerce marketplaces and FSPs need to collaborate to identify MSMEs that could embrace new business opportunities, share data responsibly to build pragmatic data-driven risk models, and offer financial products.

In almost every crisis in the past, underserved MSMEs have proven themselves to be resilient. They are hardworking and industrious, and they have little choice but to rebuild their livelihoods and thrive. But they don’t have to do it on their own. For these businesses and the communities they serve, financial inclusion is more important than ever. Financial service providers have a critical role to play in mitigating the immediate effects of the crisis on low-income individuals and small businesses and building the financial health of their clients in the long run.

Accion is helping our partners to leverage digital technologies and respond effectively to help their staff, businesses, and clients to cope with the crisis and build resilience for the future. Accion Global Advisory Solutions stands ready to advise and assist as we collectively adapt to a new normal. Contact us to learn more about how we help financial service providers put these strategies in action.