Small businesses are the backbone of India’s growing economy. There are 50 to 60 million micro, small, and medium enterprises (MSMEs) operating in the country, employing 110 million individuals and contributing nearly a third of the GDP. Despite a diverse lending landscape, access to formal credit remains a challenge for most; prior to COVID-19, it is estimated that 60 to 70 percent of all MSMEs’ credit requirements were unmet, a figure that is likely to increase given the current operational challenges institutions face. In addition, up to 40 percent of lending is informal, often with prohibitive interest rates.

In July, Accion conducted our Digital Maturity Assessment with Annapurna Finance Ltd., a non-bank financial institution based in the Odisha province of India. Through Mastercard and Accion’s partnership, Accion is working with Annapurna Finance to develop two new digital products: a low-ticket emergency loan (“just in time finance”) for group lending customers and an end-to-end digital loan for formalized MSMEs. Given the ongoing challenge and restrictions of physical loan disbursements and in-person collections due to COVID-19, these products will bring convenience and safety to both customers and staff.

Before we started this work, Annapurna Finance segmented their 14,000 MSME customers by the financial products they use. In addition to providing a more customer-centric segmentation, our research uncovered key insights, which we’ve outlined below.

There’s a gender gap in digital access and usage

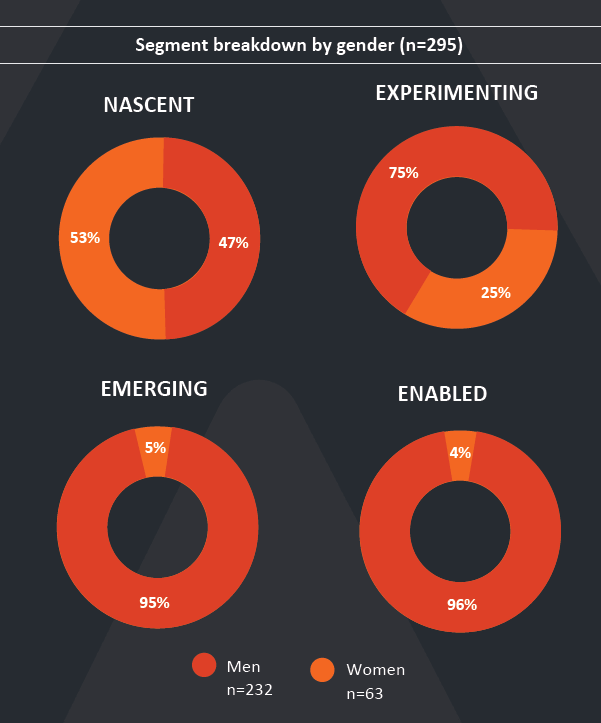

Our survey results demonstrated that women haven’t been able to embrace digital tools as much Annapurna’s male customers. We saw the largest differences when evaluating:

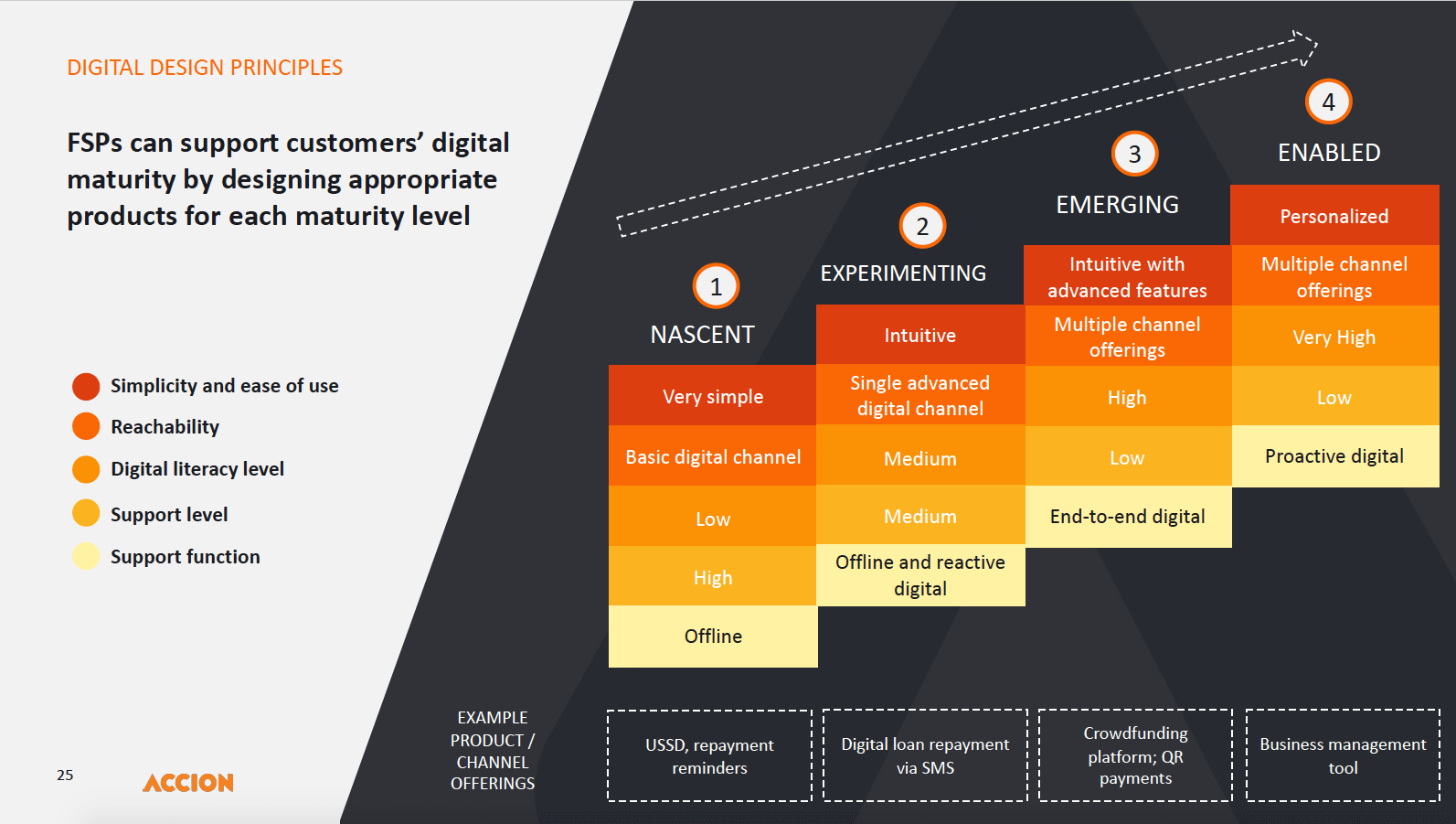

- Trust in digital tools: Women made up over half of the “nascent” segment, a segment with low comfort and trust in digital tools, but only 4 percent of the “enabled” segment: the group that is digitally savvy and willing to try more advanced digital tools.

- Device ownership: Looking at device ownership, we found notable differences in gender: only 28 percent of women surveyed owned a smartphone for their own personal use compared to 55 percent of men in the sample.

- Digital transactions: In terms of comfort in completing transactions digitally, 78 percent of women stated that interacting with a person is important to them when completing transactions compared to 49 percent of men across all maturity levels.

- Household dynamics: Anecdotally, female customers were also more likely to hand the phone to another member of the household — usually a husband or a male family member — when contacted by the enumerator for this study.

To bridge the gender gap and promote greater digital usage among women, trainings and confidence-building activities can build the financial capability of female clients, as well as their trust in the products themselves.

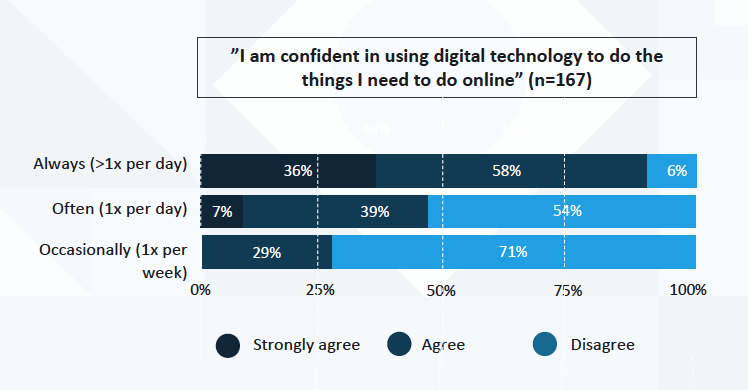

Habits lead to confidence and self-efficacy

Our findings showed a notable difference in digital confidence levels in respondents who often use digital technology versus those who use it less frequently. Of the respondents who stated that they use digital technology more than once a day, 94 percent said that they agree with the statement, “I am confident in using digital technology to do the things I need to do online.” For respondents that use digital technology only once a week, only 29 percent felt confident. Given this finding, we determined that products that are intentional about increasing digital engagement, with features like nudges or gamification, would likely have a positive impact on users’ digital confidence. With more digital confidence, clients are better suited to transition to new products and channels, giving FSPs an opportunity to introduce them to additional products.

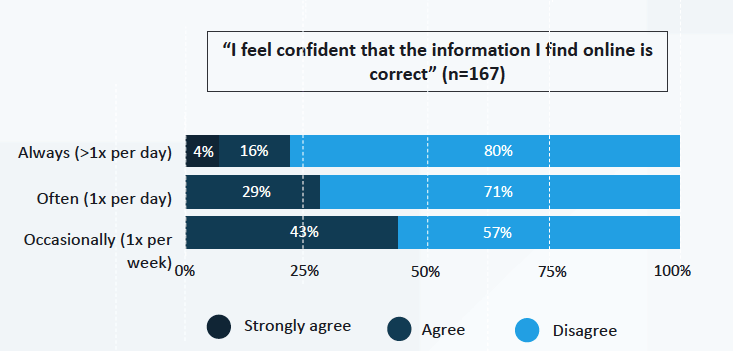

Widespread misinformation online creates adoption challenges

Even among digitally mature customers, distrust in information found online is nearly universal. Among respondents that use digital tools several times a day, 80 percent disagreed with the statement, “I feel confident that the information I find online is correct.” FSPs should consider ways to build trust in digital channels through secure messaging and authentication procedures and provide resources to help customers discern which information is truthful.

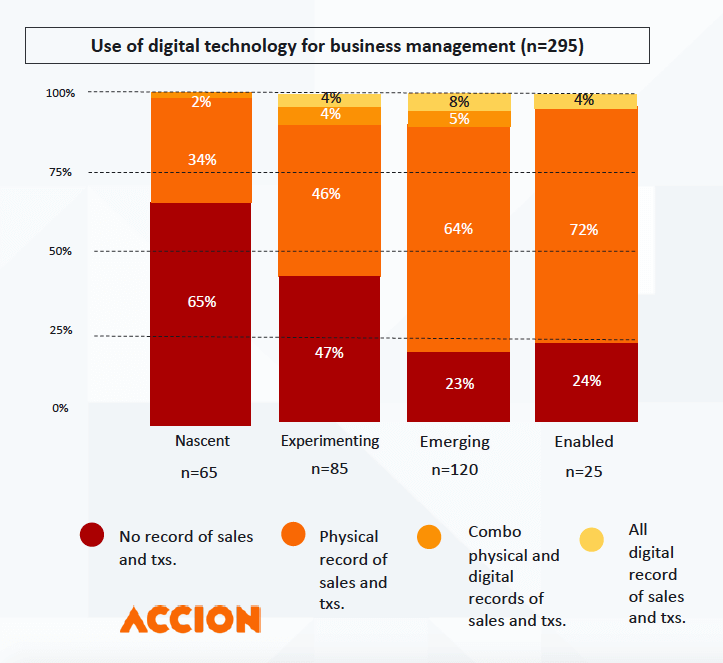

Digital marketing and business management is uncommon

We learned that only 3 percent of respondents on average, and only and 6 percent of digitally mature customers, use digital technology for business management purposes. The use of digital tools like WhatsApp and Facebook Marketplace for marketing and promotion was slightly more common, but we still found only a small proportion — 6 percent overall and 11 percent among digitally mature customers — were using digital tools for this purpose. Based on this finding, initiatives that digitize processes that customers are already familiar with, like loan repayment, may lead to greater short-term adoption compared to business management tools.

How can providers help MSMES progress in their digital journey?

Small merchants like Annapurna’s customers in India continue to face enormous challenges during the pandemic. Having access to digital tools that suit their needs can help. As trusted partners, FSPs can play a significant role in helping MSME customers progress in their digital maturity journey. However, without a clear understanding of where their customers fall on the spectrum, providers risk developing products that don’t resonate with their end users’ specific needs. Given the complexity and time commitment of gathering customer insights, especially at a time when face-to-face conversations aren’t feasible, we designed the MSME Digital Maturity Assessment to be a simple tool that leverages existing institutional resources to gather insights on customers’ attitudes, beliefs, and practices regarding digital financial services, which would be challenging to glean from transactional data alone.

Learn more about our framework for assessing the digital maturity of MSMEs and reach out to our team if you’re interested in conducting an assessment of your own customers.