Climate change is unquestionably the challenge of our times. And as climate-related events increase in frequency, unpredictability, and severity, low-income communities across emerging markets are the most vulnerable. According to the World Bank, if left unchecked, climate change will push up to 130 million people into poverty over the next ten years and could force over 200 million people to migrate away from disaster-prone geographies by 2050.

Addressing the impact of climate change on low-income populations will require a multi-faceted approach. At Accion Venture Lab, we are excited to support fintech innovations that build resilience and help susceptible communities better adapt to the climate shocks they are facing.

The rise – and limitations – of climate fintech solutions

Climate fintech is still an emerging sector, but one that is gaining steam fast. Investments in climate fintech reached $2.9B in 2022, more than twice what was raised the year before. This growth is encouraging, and we’re excited to see the range and depth of new innovations emerging in this space.

However, while the scope of climate fintech is vast, the majority of funding is going to solutions around climate mitigation, which aim to reduce or avoid further emissions of greenhouse gases. Fintech solutions like carbon accounting and carbon offsetting are important tools for corporations and individuals alike to better monitor and manage their carbon emissions. Yet for the world’s most vulnerable, mitigation is not enough.

The poorest 50 percent of the world’s population contributes half the emissions of the richest one percent. Despite this, they will pay the highest price for climate change if action is not taken immediately. To address the challenges they face, we require different paths.

Emerging opportunities in climate fintech

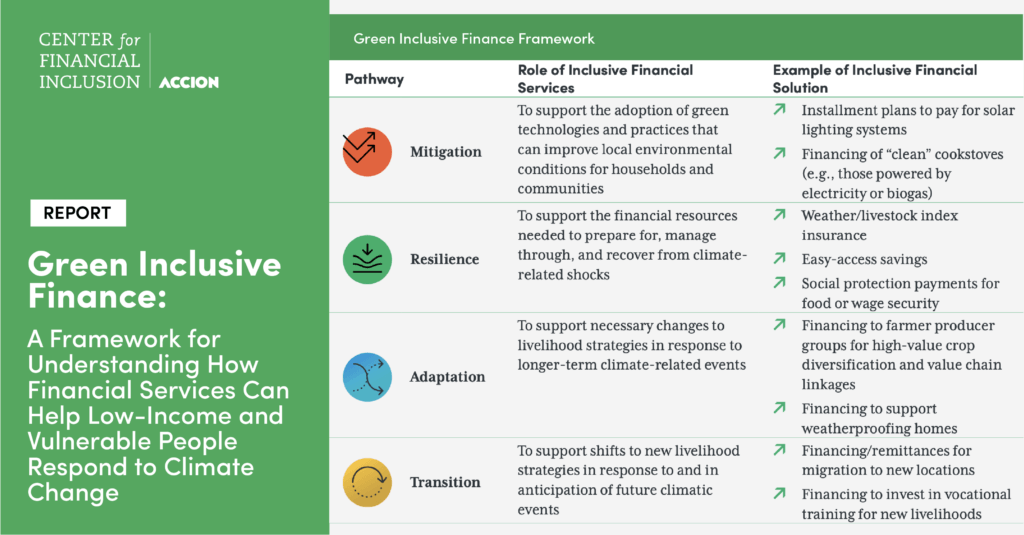

Our colleagues at the Center for Financial Inclusion recently released the Green Inclusive Finance framework, which describes four impact pathways for how inclusive finance can be used by low-income households facing climate shocks: mitigation, resilience, adaptation, and transition.

We believe this is a valuable framework for evaluating how and where inclusive finance can play a role in responding to climate change. Beyond mitigation, we need solutions that help people absorb climate-related shocks (“resilience” models) as well as enable communities to prepare their families and livelihoods for actual or expected climate changes (“adaptation” models) or, in more extreme cases, seek out new livelihoods entirely (“transition” models).

We hope to see more solutions – and more investments made – in fintech companies tied to climate adaptation and transition for low-income and vulnerable populations. The work comes from not only building these solutions but innovating in how they can scale. Core to this will be how we build incentives for low-income communities to adopt new practices and the financial services that enable them. We’ve seen models fail because they expect vulnerable populations to willingly change their behaviors in the face of actual or expected climate changes. However, the incentive to change needs to be crystal clear. For example, how does introducing a new way of farming or weatherproofing one’s roof result in higher, more stable incomes or lower costs? We’re excited about companies that are thinking about not just new use of technology but ways to design, communicate, and deliver these incentives.

Startups bringing innovation to those affected by climate change

We have already invested in a number of climate fintech startups working around the world, particularly in startups building technology for climate-resilient agriculture. Agriculture will continue to feel outsized impacts from climate change, and financial services can play a critical role in helping smallholder farmers and the entire agricultural value chain adapt their practices.

The impact of our current portfolio companies includes:

- Driving resilience for smallholder farmers: Pula provides farmers across Africa access to cutting-edge insurance and helps protect farmers against the risk of financial losses due to climate-related events. These events – unpredictable rains, droughts, and pests – impact farmer yields and result in reduced production and incomes. Pula’s insurance is a valuable solution to ensure these farmers are resilient to the changing conditions around them.

- Improving financial access for aquaculture farmers: AquaExchange supports aquaculture farmers in India who often lack the technical knowledge and financing to sell their harvests. Through its platform, AquaExchange helps farmers monitor their farms in real-time using a unique wireless sensor, buy resources, sell crops, and find appropriate routes to credit. Not only does the company enable aquaculture farmers to build more resilient farms, but they can also earn more income while supporting the global food supply and generating a positive environmental impact.

- Helping farmers maximize their profits and be more climate resilient: Apollo Agriculture helps farmers in Kenya and Zambia access high-quality farm inputs, financing, and markets by using satellite imagery and AI. Apollo provides farmers with timely information on weather patterns and soil conditions so they can adjust their farming practices and minimize their exposure to climate-related risks. This bundling of optimized advice, insurance, inputs, and financing enables farmers to establish more sustainable practices and increase their incomes and adapt to changing climate conditions.

- Digitizing the agriculture industry: Semaai‘s digitization efforts support Indonesia’s agriculture industry in becoming more sustainable and climate resilient. By enabling local sellers of agricultural products to access and track inventory digitally, Semaai helps to reduce waste and optimize resource use in the agricultural supply chain. The company also provides a transaction history for shop owners, which they can then use to purchase inventory on credit – increasing incomes and alleviating cash flow issues and the barrier of limited financing opportunities in the country.

Moving climate fintech forward

The road ahead for climate fintech is promising, and we are excited to see more innovation in the coming months and years ahead. Like any emerging field, there are challenges to navigate along the way. We’re aware of how climate fintech solutions can fall prey to greenwashing. Greenwashing can be intentional or unintentional, as many companies are still learning how to measure their impact accurately, and how to honestly communicate and meet their sustainability goals. It’s therefore important that climate fintech startups embrace frameworks and guidance on calculating their impact and realistically scaling it over time.

There is also work to do in consumer protection and data privacy in climate fintech (as there is in inclusive fintech more broadly). Organizations collaborating with vulnerable communities must handle personal and sensitive information with extra care. Climate fintechs may also need to educate users about online safety and digital data management.

At Accion Venture Lab, we look forward to addressing these challenges together with the climate fintech companies in our current and future portfolio. We are ready to learn how to empower vulnerable communities and support solutions that help people manage climate risks and participate in a more sustainable, equitable future.

If you’d like to learn more, check out the latest season of our Fintech for the People podcast and hear from some of the trailblazing founders and investors in this space.