Building a resilient and inclusive future

We open opportunity to rebuild, adapt, and thrive:

The COVID-19 pandemic is the most severe challenge to face low-income and underserved people in our lifetimes—threatening their survival and ability to provide for their families. In 2020, Accion worked to ensure vulnerable people can access the financial tools they need to safely save money, grow a business in our increasingly digital economy, or better protect themselves in a crisis.

The pandemic exacerbated economic inequalities that have made life harder for low-income people, women, and other underserved groups. Accion quickly pivoted to start bridging these divides and build the resilience of our partners and their vulnerable clients. We leveraged digital technology to expand access to financial tools that help people live healthier, safer, more prosperous lives—tools usually denied them. We invested in the entrepreneurs and companies that provide inclusive financial services. We guided and advised these companies and others to ensure their success. And we conducted rigorous research and advocacy to advance inclusive financial systems for low-income people around the world.

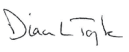

A letter from our CEO and Board Chair

Dear Friends,

The COVID-19 pandemic has forever changed our world. Millions have lost their loved ones, their livelihoods, or both. Decades of progress in reducing global poverty and expanding access to financial services have been put at risk. Lockdowns and social distancing have moved entire businesses online, threatening to leave behind those without the right skills and tools. Low-income people and small businesses are struggling to survive, and their road to recovery is more fraught than anyone else’s.

Accion is building an inclusive economic recovery by enabling people to access the financial products and services they need. Underserved people need savings, credit, and insurance, as well as digital skills and tools, to successfully pivot a business and build financial resilience for their families. During the crisis, inclusive financial service providers also have faced their own challenges, with potentially devastating consequences for millions of small businesses that depend on them for funding and growth.

Accion worked to ensure our partners around the world could continue supporting their vulnerable clients. With our partners, we provided entrepreneurs with forbearance and flexibility, so they had time to restart their businesses. We leveraged digital technologies to enable partners to stay in touch with clients and support those most in need. We quickly pivoted our research to understand the impact of the pandemic on small businesses. We also transformed how we work—strengthening our ability to provide all our support to partners and clients remotely.

Families and small businesses have inspired us with their resilience and ability to adapt against overwhelming odds.

Ultimately, our work has helped clients keep their businesses open, keep providing for their families, and gain the tools and skills they need to rebuild and grow.

As the recovery is picking up in wealthy countries, that’s not the case for low-income people in emerging markets, who are still dealing with extreme challenges. Yet families and small businesses have inspired us with their resilience and ability to adapt against overwhelming odds. With your support, we will continue enabling those most affected by the crisis to rebuild their livelihoods and participate in our increasingly digital economy—laying the groundwork for an inclusive recovery that opens opportunity for all.

Michael Schlein and Diana Taylor

With access to simple financial tools like digital credit, crop insurance, and mobile payments, people around the world can build better futures. Watch the video to see how we connect people and small businesses to the tools they need to thrive.

Global impact

170+

Since our founding, Accion has helped build more than 170 institutions in 55 countries.

190M+

In 2020, our work reached more than 190 million people.

10M+

More than 10 million people accessed credit through our partners.

70%

70 percent of our partners’ borrowers are women.

9M

Nearly 9 million people saved money through our partners.

4.5M+

Our partners disbursed 4.5 million loans to small businesses and families.

10M

Nearly 10 million people accessed insurance through our partners.

How we work

In 2020, Accion empowered vulnerable people and small businesses to access the financial tools, resources, skills, and knowledge they need to save money, start selling goods online, and recover from significant disruptions to daily life. Financial services like savings accounts, credit, insurance, and digital payments are critical to helping underserved groups build financial resilience and gain a foothold in our rapidly digitizing economy.

Accion supported underserved families and businesses facing unpredictable challenges—as well as the financial service providers striving to empower them—by:

- Investing in the entrepreneurs and companies that provide inclusive financial services.

- Guiding and advising the management teams of these companies and others to ensure their success.

- Studying and sharing successes, to export best practices to other companies and countries and overcome barriers to progress.

- Conducting rigorous research and advocacy to advance inclusive financial systems for low-income people around the world.

Our teams

Accion Global Advisory Solutions partnered with financial service providers around the world to better meet the needs of underserved people and small businesses. In response to the challenges brought on by the pandemic, we enabled microfinance banks to quickly leverage new technologies to stay connected with clients, ensure quality services, and lower the cost of financial services at scale. Through our global partnership with the Mastercard Center for Inclusive Growth, our work has impacted the lives of nearly 6 million people and supported the development of new products, better customer experiences, and improved data capabilities.

Our advisory team supported Banco Pichincha, the largest private bank in Ecuador with 3.5 million clients, in building a digital financial inclusion strategy to support microentrepreneurs who’ve long lacked access to the digital economy. As Ecuador became an epicenter of the pandemic in Latin America, Banco Pichincha’s clients needed digital tools to continue serving customers during lockdowns and to build financial resilience. This work included driving uptake of the bank’s newly launched digital wallet among micromerchants and low-income consumers, building a strong merchant value proposition for digital transactions, and exploring opportunities to strengthen and digitize supply chains through financing.

Accion Global Investments supported inclusive, well-managed, and scalable financial service providers around the world as they dealt with many challenges. We assisted local partners with keeping their staff and clients safe by setting up remote work and digital payment channels. We collaborated to anticipate cash flows and restructure payments in accordance with regulations and the needs of clients. We worked with our partners to ease the payment burdens on clients to allow them more time to recover and rebuild. And we helped assess the impact of the crisis on partners’ balance sheets and guided their steps to build resilience.

The Accion Global Investments team supported Financiera FAMA in providing responsible loans to families and microentrepreneurs in Nicaragua, where only one-third of adults have access to a formal bank account, and where a devastating combination of challenges have made life even harder for low-income people. Beginning in 2018, political violence triggered an economic recession from which Nicaragua is still emerging. In 2020, Nicaraguan families and small businesses struggled to make ends meet during the COVID-19 crisis. And climate change brought even more problems in the form of two major hurricanes that caused severe flooding and landslides throughout Central America in November 2020. We worked to support FAMA and their clients in these difficult circumstances, and in 2020 Accion Global Investments provided additional funds to ensure FAMA could continue serving vulnerable families and small businesses. Amid widespread instability, FAMA offers a beacon of hope for distressed communities and is working to empower them to build financial resilience for a brighter future.

Accion Venture Lab invested in and supported innovative seed-stage fintech startups that are improving the accessibility, quality, and affordability of financial services for the underserved. During the crisis, the Accion Venture Lab team enabled portfolio companies to strengthen their financial positions, adjust their go-to-market approaches, and get set up for extended periods of remote work. Accion Venture Lab portfolio companies leveraged the power of innovation and digital technology to ensure vulnerable groups could build resilience during the crisis. Pintek helped schools and students in Indonesia access credit and financial tools they needed to weather the crisis, and also worked with an EdTech platform to help schools shift to online learning. Field Intelligence, a portfolio company operating in Nigeria and Kenya, helped community pharmacies leverage AI and data analytics to manage their inventories during supply chain disruptions, and continue focusing on serving their customers.

Despite the uncertainty of 2020, Accion Venture Lab continued to find and fund innovative fintechs, like TerraMagna in Brazil. TerraMagna offers financing to small and medium sized farmers who are often excluded or poorly served by local lenders. TerraMagna leverages satellite imaging technology and various data sources to allow retailers to better underwrite loans for the inputs farmers need each planting season.

Accion Venture Lab is applying a gender lens investment strategy to support broader economic and social well-being. This process involves looking at the gender composition of their own team, as well as the leadership, staff, and customer base of portfolio companies to understand how best to bridge persistent gender gaps. In 2020, with support from the S&P Foundation, Accion Venture Lab also hosted a series of workshops for female fintech founders in Brazil, Mexico, and India to support the broader ecosystem of early-stage innovators.

Our strategic partnership with Quona Capital, a venture capital firm that invests in growth-stage fintech companies in emerging markets, continued developing the financial inclusion ecosystem around the world. Our partners at Quona are exploring important trends in the market, including embedded finance, which allows almost any company to offer a range of financial services. Kenya-based portfolio company Sokowatch is embedding financial services and products into the retail supply chain to put the power of ecommerce into the hands of informal retailers in East Africa. Quona-managed portfolio companies are also developing personal financial management tools to empower more people take control of their financial futures. For example, portfolio company Cowrywise is expanding access to wealth management tools for low-income consumers in Nigeria.

In 2020, we announced the final close of the Accion Quona Inclusion Fund, with $203 million in commitments—significantly exceeding its $150 million target—from array of leading investors. The fund is investing in scalable stage fintech companies that are expanding access to financial services for underserved consumers and small businesses in Latin America, Africa, India, and Southeast Asia. For example, in 2020, the fund made a follow-on investment in Klar, an online bank that is expanding access to financial services in Mexico, where only 10 percent of adults have a credit card. Klar has supported more than 200,000 customers with a range of banking services including credit debit, and loans—with an average loan size of just $110.

Our work around the world

Millions of individuals and small businesses across India, especially those living in hard-to-reach rural areas, lack access to formal financial services. Backed by investments from Accion Global Investments and support from Accion’s advisory team, our partner Sub-K provides a technology-enabled financial platform for India’s unbanked and underbanked communities, serving more than 5 million clients.

Sub-K is participating in our global partnership with the Mastercard Center for Inclusive Growth, which seeks to enable more people and small businesses to participate in, and benefit from, the digital economy. Through the partnership, our advisory team supported the development and launch of SARTHI, Sub-K’s new digital financial services marketplace for small businesses. SARTHI will provide a range of financial service options, including microcredit and health insurance—initially through assisted channels and subsequently from mobile devices.

Accion has partnered with MetLife Foundation to leverage digital solutions to enhance underserved customers’ financial capabilities and engagement. In Latin America, we are working to better understand customer needs and help financial service providers design, test, and implement innovations that drive usage and improve customers’ financial capabilities.

For instance, we worked with Chilean fintech company Organizame to tailor their online business management tool to better serve low-income clients and enable them to improve their businesses. The mobile app digitizes business operations like cash flow management, bill payment, and credit applications to help entrepreneurs to consolidate business transactions and send electronic documents. In 2020, Accion Global Advisory Solutions published insights and lessons learned from the project with MetLife Foundation in the brief “To succeed, innovative financial products must be desirable, feasible, and viable”—enabling our work to serve as a demonstration model for the entire industry.

Inclusive fintech startups faced a host of challenges in 2020, including unpredictable funding, a volatile investment market, and a severe economic downturn. But these companies rely on growth for success—often through costly customer acquisition. In 2020 Accion Venture Lab published a report focused on enabling these startups to “win from within” by creating real value for their existing users.

The report, developed with the support of Mastercard Foundation, featured nine case studies of Accion Venture Lab portfolio companies that successfully retained and grew their client base by focusing on customers’ specific needs. For instance, NOW Money provides payroll services to employers of migrant laborers in the United Arab Emirates. NOW Money helps workers use a bank account, debit card, and smartphone app from which they can make local payments, international remittances, and cash withdrawals at local ATMs. Migrant laborers tend to have low trust in financial institutions, given their exclusion from the financial system. In response, NOW Money promoted mobile top-ups to encourage users to maintain balance in their accounts and create an entry-level product for migrants to build trust through low-risk, low-cost transactions.

Group lending allows people in the same communities to guarantee each other, typically relying on in-person meetings and social collateral to serve those without any credit history. Our partner Annapurna Finance, currently serving more than 1.9 million clients, caters to these and other underserved clients across India who would otherwise lack access to quality financial services

Through our partnership with the Mastercard Center for Inclusive Growth, our advisory team worked with Annapurna to reimagine the group lending process for our socially distant world by including digital tools and channels in the group lending process. Only 15 percent of Annapurna’s group lending customers own a smartphone, but a greater percentage have access to less advanced feature phones. To address this digital divide, we created an SMS-based digital emergency loan product that incorporated both tech and touch elements. Interested customers can provide a few details to their loan officer to ensure they meet the qualifications. If qualified, the customer can request disbursement of a loan through SMS and the funds are credited to the beneficiary’s bank account almost instantly.

Through a series of virtual discussions, we convened CEOs of microfinance institutions and fintech startups, policy experts, and technical advisors to share their latest insights, successes, and failures with their peers and the entire field. Across Accion, we hosted conversations on topics including the digital transformation of small businesses, adapting group lending for our digital world, cybersecurity risks and opportunities, leadership during the pandemic, and closing the digital divide through EdTech platforms.

While the COVID-19 pandemic increased demand for digital financial services, it also created uncertainty for fintechs looking to raise capital while revenues fell, and as remote work and economic uncertainty strained their human resources.

As this new reality emerged, the second year of Inclusive Fintech 50 launched. An initiative funded by MetLife Foundation and Visa Inc., with support from Accion and International Finance Corporation, and additional funding from BlackRock, Jersey Overseas Aid, and Comic Relief, Inclusive Fintech 50 creates visibility for the most promising inclusive fintechs addressing the challenges of underserved customers. An independent judging panel selects high-potential fintech startups that may not yet be on the radar of investors. The 2020 competition attracted 403 qualified applicants operating in 111 countries and reaching 116 million customers.

In 2020, the competition provided cash prizes to two winners that demonstrated a particularly strong commitment to supporting their customers’ financial resilience during the crisis. One of these companies was reach52. A fintech with operations in Cambodia and the Philippines, reach52 provides microinsurance directly to rural consumers through their marketplace service and networks of predominantly female area managers. The company operates in communities that are over an hour away from health and financial services facilities and with family incomes of USD $2-8 per day.

The Center for Financial Inclusion

The Center for Financial Inclusion (CFI) works to advance inclusive financial services for the billions of people who currently lack the financial tools needed to improve their lives and prosper. We leverage partnerships to conduct rigorous research and test promising solutions, and then advocate for evidence-based change. CFI was founded by Accion in 2008 as an independent think tank on inclusive finance.

The global pandemic energized CFI’s purpose and its efforts to support an inclusive economic recovery that uplifts the most vulnerable people around the world. In 2020, CFI launched a new strategy that focuses on addressing the most pressing challenges of today and those to come. CFI continues to conduct research and produce evidence-based insights that inform the work of investors, policymakers, donors, and financial service providers as they support vulnerable households and businesses in recovering from the crisis and building the financial resilience they need to grow and thrive.

In 2020, CFI launched a new strategy that seeks to move the industry beyond expanding access to financial services and toward improving outcomes for low-income clients. The strategy focuses on four thematic priorities—all of which have been exacerbated or complicated by the global pandemic. They include responding and adapting to the risks of climate change, advancing women’s financial inclusion, exploring data risks and opportunities, and protecting consumers in the digital economy.

Learn more:

In 2020, CFI completed a strategic integration with MIX, a leading global data resource for socially responsible investors and businesses committed to financial inclusion. MIX has leveraged its expertise in data across fintech, digital financial services, and agricultural finance—developing common standards and language, providing clarity around complex data, and generating strategic insights to help these sectors flourish. The addition of MIX has strengthened CFI’s industry-leading influence and analysis with proven data expertise.

Supported by the Mastercard Center for Inclusive Growth, CFI continues to release results of a survey of micro, small, and medium-sized enterprises (MSMEs) across 4 countries—Colombia, India, Indonesia, and Nigeria—to understand the impact of COVID-19 on business activities and the lives of the MSME owners. In the survey’s first wave, results showed a severe impact on MSMEs: 15 percent of MSME owners reported their business closed at the beginning of the pandemic, and 83 percent of businesses saw their profits decline. Results from the survey’s second wave show cause for cautious optimism, as MSMEs are generally on an upward trajectory after weathering the initial economic devastation caused by the pandemic. Closures declined by at least 50 percent, and in every market other than Indonesia, the share of businesses with profits that stayed the same or increased was larger than the share of businesses with profits on the decline.

In 2020, CFI also conducted research to assess how policymakers are responding to COVID-19, as well as case studies on investors responses to previous crises and the lessons that can be drawn for this pandemic.

More than 1,200 people registered for CFI’s 2020 Financial Inclusion Week, which convened policy experts, analysts, and industry leaders in discussion on responding to the global pandemic and other priorities laid out in CFI’s new strategy. The agenda featured more than 40 sessions covering a broad spectrum of topics, including how financial services can mitigate and adapt to climate risk, women’s financial inclusion, data opportunities and risks for financial inclusion, and consumer protection.

While more and more people have access to mobile phones globally, billions still lack access, and the digital divide is even more pronounced for women. Low-income women are also more likely to have low levels of financial literacy than men. With the support of a new planning grant from the Bill & Melinda Gates Foundation, CFI will apply a gender lens to their research initiatives to understand these and other persistent gender divides around the world. This initiative is illuminating the financial tools and delivery models that are more successful at engaging and supporting female customers, providing actionable insights for inclusive financial service providers.

Client stories

“I tried every possible way to get the loan, but it was Sub-K who understood my pain.”

Pallavi is the co-owner of Navya Collections, a garment shop in Warangal, India that focuses on selling saris. Her mother started the store with a small investment, nearly her entire savings, which she used to make 50 to 100 saris. When Pallavi needed a loan to expand the business, other lenders turned her down, but Accion partner Sub-K provided the financial lifeline she needed.

“My partner in progress.”

As hospitals reduced appointments during the pandemic and patients avoided clinics, more people across Sub-Saharan Africa relied on their neighborhood pharmacies for essential medications and basic health services. This includes Euness Pharmacy, owned and operated by Udodirim Agwu in Abuja, Nigeria.

On top of the challenges of running a small business, pharmacists like Udodirim struggle with the complexity of managing a supply chain upended by the pandemic. Field Intelligence, an Accion Venture Lab portfolio company, helps pharmacies in Kenya and Nigeria manage their inventory through their Shelf Life subscription service. Pharmacists order the medicine and products they need through the platform, and Shelf Life delivers it directly to them.

“They save us costs—big ones—because we don’t have to go and pay transport fees to come procure the goods,” says Udodirim. “They bring them right here to the shop. Secondly, they educate us about our drugs that are about to expire…which also gives us ease of doing business,” she added.

Michael Moreland, co-founder and CEO of Field Intelligence, says pharmacies like Udodirim’s are “the front line of the health system in their communities.” He explains, “In these markets where there is such a tremendous shortage of doctors and formal health care services, these local community pharmacies provide an enormous amount of basic primary and essential care to their communities.”

As the pandemic unfolded, supply chains were quickly turned upside down, and prices for routine medicines—especially vitamin C and acetaminophen—went through the roof. Using their data capabilities, Field Intelligence worked to stabilize prices for their pharmacy customers and continued supplying them with critical products that they couldn’t procure on their own.

For Udodirim, the costs, time, and headaches she’s saved thanks to Field Intelligence have made a world of difference for her business. “Shelf Life has been so tremendous,” she says. “It’s been my partner in progress.”

“The drive to be an entrepreneur was always in me.”

Valonne Smith had long noticed that Black women like herself lack options to take care of their hair without harsh treatments and chemicals. That’s what initially inspired her to open her own salon called Natural Do in Stockton, California.

Valonne applied her previous experience in business management, as well as her sister’s experience as a cosmetologist, to get the business started. “The drive to be an entrepreneur was always in me—it was just about finding the right fit. And when I found it, I took the plunge,” she says.

Valonne’s clients enjoy the upbeat and happy atmosphere in her salon. “And our salon smells good, because we’re not frying hair with chemicals!” she says. “We teach people to love and care for their hair just the way it is, without the breakage from harsh treatments.”

In 2018, a couple years after starting Natural Do, Valonne needed a loan to grow her business and reach more customers, so she applied for working capital through Opportunity Fund, now part of Accion Opportunity Fund. “The process was simple, and I was able to get the working capital right away,” she says.

The pandemic forced Valonne to temporarily shut down her salon for months, threatening the survival of her business. She checked in with her two full-time employees every week, often sending them information on unemployment benefits and grants.

Valonne was very relieved to receive a $5,000 COVID-19 relief grant from Accion Opportunity Fund—the organization formed in 2020 when Accion U.S. Network united with Opportunity Fund. The grant was made possible by the Small Business Live virtual concert and fundraiser benefitting Accion Opportunity Fund in June 2020, featuring performances by superstars Ms. Lauryn Hill, Leon Bridges, Brittany Howard, and more.

Valonne immediately used her new funds to finish paying off her original loan from Opportunity Fund. Now, she has a brighter outlook for the future. As she starts safely reopening, she’s already formulating plans to expand her vision for black women’s hair care into the Bay Area.

Accion Opportunity Fund

U.S. small businesses anchor local economies while creating opportunities for their families, their employees, and their neighborhoods. Yet business owned by people of color, women, and immigrants often struggle to secure capital and resources, as they are systematically shut out from traditional financing.

In the U.S., Accion has worked for more than 25 years to create an inclusive and healthy financial system that supports the nation’s small businesses by connecting entrepreneurs to affordable capital, educational resources, coaching, and networks. We focus on underfunded entrepreneurs who often lack access to the financial services they need to build and grow their businesses. In 2020, Accion’s U.S. Network team joined forces with Opportunity Fund, a community development financial institution based in California, to form Accion Opportunity Fund. This furthered the organizations’ joint missions of scaling mission-based lending and business support services across the United States.

Our impact in 2020

90%

90 percent of loans have gone to entrepreneurs of color, women, or immigrants over our history.

$69.2M

We loaned $69.2 million to small businesses through 2,287 loans.

$6M

We provided $6 million in financial relief to struggling small businesses.

10K+

We provided expert advice to more than 10,000 entrepreneurs.

676K+

More than 676,000 people accessed our educational resources.

Even before the pandemic, nearly half of the United States’ 30 million small businesses only had enough cash on hand to operate for 15 days without customers. As they closed their doors during quarantine, paychecks for millions of workers were put in jeopardy, with serious implications for their families, communities, and the entire economy. In 2020, Accion Opportunity Fund responded to the needs of some of the most vulnerable small business owners by providing financial relief and access to capital. In 2020, we disbursed 2,287 loans totaling $69.2 million to small businesses across the United States. This included facilitating $17.9 million in Paycheck Protection Program (PPP) loans to a total of 1,160 small business owners. We also deployed a total of more than $6 million in financial relief through loan payment deferment and forgiveness, low-interest loans, and grants.

As the pandemic unfolded, small business owners across the U.S. asked the same difficult questions: Can I stay open? Can I keep in touch with my customers when my store is closed? How do I navigate difficult conversations with my employees? For many entrepreneurs, few opportunities to connect with their peers created a feeling of isolation.

Accion Opportunity Fund organized a COVID-19 response webinar series to support small business owners in these difficult circumstances. Over 30 webinars, we reached more than 10,000 people in 49 states with expert advice and insights on a range of topics including staying connected to customers, crisis management, cybersecurity, fraud prevention, navigating unemployment, adapting supply chains, cash flow management, and more. About 60 percent of participants identified as people of color and 68 percent as women. We also continued to create new digital educational content in our Business Resource Library to address timely and urgent challenges facing small business. In 2020, we saw a 50 percent increase in traffic to these educational resources, reaching more than 676,000 people over the year, an estimated 60 percent of whom were women.

“I wanted to make sure to let you know just how helpful, important, and emotional the webinar you presented was this afternoon,” said one participant. “Thank you for sharing this information and these resources. It created a little feeling of relief that there are people out there with knowledge and the willingness to help.”

Small businesses struggled to make ends meet during the pandemic, and they needed support to keep their lights on. This urgent need prompted the music festival organizer Superfly to host Small Business Live, a virtual music experience to benefit small businesses owned by people of color across the United States. Hosted in June 2020, the event featured live performances from some of music’s biggest stars, including Lauryn Hill, 2 Chainz, Brandi Carlile, Brittany Howard, Leon Bridges, and T-Pain, to raise money for small business grants. The event generated over $1 million in donations to support small business and attracted a live viewing audience of 9.7 million.

In August 2020, Accion Opportunity Fund received a transformative grant of $15 million—the largest individual donation in its history—from author and philanthropist MacKenzie Scott. The grant has accelerated Accion Opportunity Fund’s goal to reach thousands of underfunded entrepreneurs with $1.2 billion in capital across the United States in the next five years and kicked off a $100 million campaign to increase the credit, connections, and business advice available to underserved entrepreneurs.

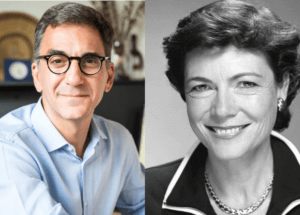

In memoriam

Joseph H. Blatchford, 1934-2020

In October 2020, Accion’s founder and beloved member of the Accion family Joseph H. Blatchford passed away at the age of 86. Joe was a courageous and charismatic leader who overcame cultural and economic differences to help disadvantaged people around the world.

Joe founded Accion to recruit young Americans to build schools, drainage channels, and other infrastructure projects for low-income communities in Latin America. He wrote, “We believe that the collective initiative of hundreds of such communities can bring progress without bloodshed, and champion the most revolutionary idea of all—the dignity of the individual human being.” Joe’s vision was to provide vulnerable people with the tools they need to help themselves—and while the tools have changed, his vision remains.

The foundation Joe built positioned Accion to become a global leader in expanding financial inclusion to benefit underserved populations around the world. After Accion issued its first loans to small, informal enterprises in Brazil in 1973, Accion’s clients shattered the myth that the poor were bad credit risks. Given access to affordable capital, they could and would improve their lives. From that point on, Accion expanded a network of microfinance programs and partners across the world, and harnessed new technologies to meet the needs of low-income clients. Joe’s pioneering spirit lives in our work, and Accion’s staff continues to find inspiration in his legacy.

Kurt Koenigsfest, 1965-2021

In February 2021, Accion lost a dear friend and colleague: Kurt Koenigsfest, CEO of our longtime partner BancoSol in Bolivia. A champion for financial inclusion, Kurt led BancoSol since 2000, and his work pioneered the commercial model of microfinance that today is used across the world to enable millions of low-income people to access the basic financial tools they need to build better lives.

Under Kurt’s leadership, BancoSol provided more than 1.5 million low-income consumers and small businesses in Bolivia with the high-quality financial services they need to grow and thrive. And throughout the COVID-19 pandemic, Kurt oversaw the rollout of digital financial products that allowed customers to continue to access essential financial services during lockdowns and uncertain circumstances.

In Kurt’s memory, Accion and BancoSol partnered to create the Kurt Koenigsfest Memorial Scholarship Fund to help provide educational scholarships for the children of BancoSol’s hardworking clients, who mattered so much to Kurt. The field of financial inclusion lost a leader much too soon, but Kurt’s legacy lives on in the families, small businesses, and communities he helped support, and it will continue to inspire our work to build a financially inclusive world.

Together, we can build a better, more inclusive future

Our work remains more urgent than ever. We rely on the support of visionary individuals, and innovative global partnerships across the public and private sectors to enable and amplify our work. Together, we can create a more inclusive economic recovery—where every individual has access to resources and services to build resilience, seize opportunities, and reach their full potential.

Accion 2020 financials

Accion’s most recent audited financial statements are available here.

Board of Directors

You can view Accion’s Board of Directors here.