Written by Ava Chang, Summer Associate at Accion Venture Lab

In the early days of a startup, attracting talent and retaining employees can be major challenges. Building employee stock option plans (ESOPs) into recruitment and retention strategies can give early-stage companies a competitive edge and create an energized and motivated workforce. Several studies from the Employee Ownership Foundation found that firms offering ESOPs have significantly higher sales growth and sales per worker than matching firms without ESOPs.

While providing ESOPs to all staff is common, strategies can differ based on a number of factors, including tenure (e.g., join date), job level, and team.

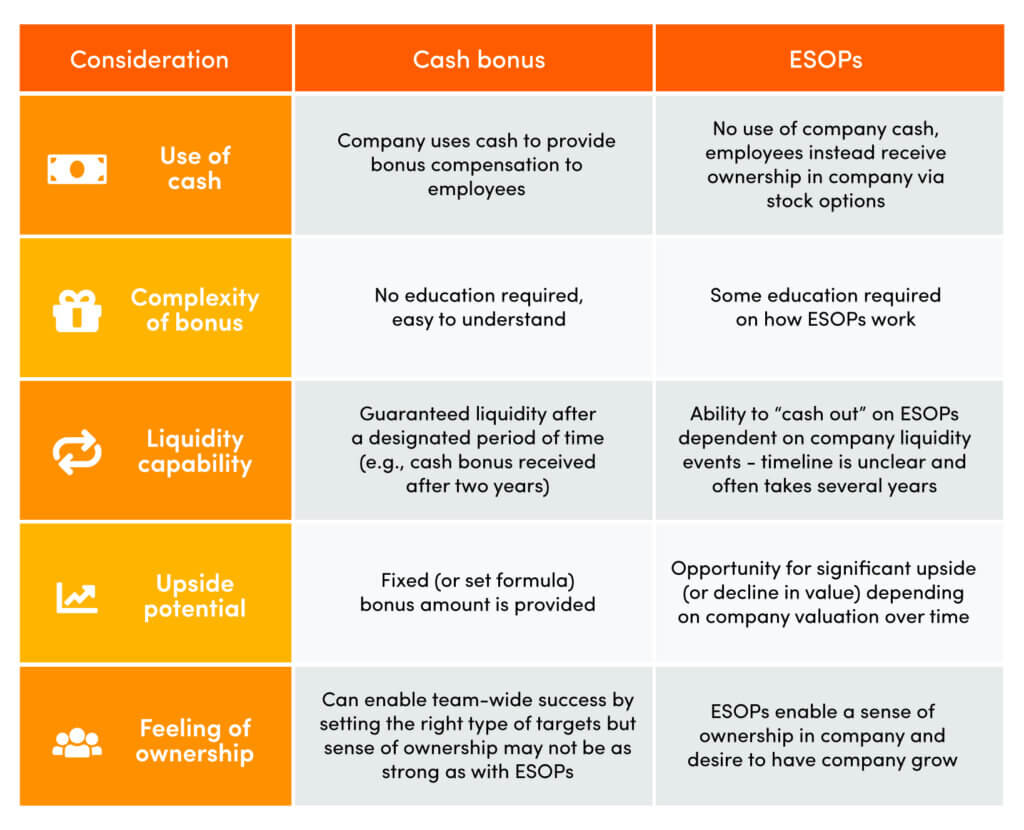

Stock options are often also provided as a “top-up” to high-performing employees. There are, of course, other ways to offer bonus compensation to employees, including cash bonuses for hitting certain targets.

But for startups who want to leverage cash for other strategic needs to accelerate growth, stock options are a sensible option.

There are a number of other powerful reasons for your startup to provide ESOPs:

- Recruit, retain, and incentivize talent

Providing ESOPs motivates your team to work for the company’s growth and its long-term success. As the company grows and performs well, the employees also share in the company’s success.

- Encourage employee ownership

ESOPs can provide employees with a stronger feeling of belonging, enhancing their long-term commitment to the organization. A “we’re in this together” mentality is especially important at the earliest stages. This is further manifested with voting rights and, potentially, dividends at later stages.

- Develop attractive compensation mechanisms when one can’t pay competitive salaries

Startups often need to use their limited cash for other strategic needs, such as to fuel growth, and therefore cannot pay as competitive a salary as bigger, more established companies. For many people who leave big companies to work for startups, the employee stock ownership plan is a major draw.

ESOPs are not yet readily leveraged in countries with early tech ecosystems

While ESOPs are commonly offered and understood in countries with mature tech ecosystems, including the United States and India, Accion Venture Lab has found that this often isn’t yet the norm in markets with an emerging tech ecosystem. In sub-Saharan Africa, for example, employee stock ownership plans are still uncommon. Arrangements are often only for founders and top executives to have equity in their companies.

From our discussions with stakeholders in these regions, we’ve found that ESOPs are uncommon for a few reasons:

- There is often a lack of understanding of stock options and how they work.

- Employees question if and when they would be able to “cash out” and often prefer immediate liquidity.

- Employees may be risk-averse and worry that they would ultimately earn nothing if the value of the company declines.

Hence, cash-based salaries and rewards are still the norm to provide compensation and promote retention. While we don’t suggest that companies stop using cash bonuses, which we believe also have their merits, we encourage companies to explore ESOPs as a tool to motivate and retain their teams and create a culture of ownership and community.

More and more early-stage companies in sub-Saharan Africa are leading the charge in instituting option plans and ensuring their employees share in the upside and receive compensation for their hard work.

Four ways to set up your ESOPs strategy for success

To develop and institute an ESOP plan successfully, your employees must understand and be excited about the prospects of such a plan.

We recommend taking the following steps, based on our conversations with founders and other investors in our markets:

- Understand how ESOPs are perceived in your market

Speak with HR professionals, your teams, and other founders and investors to learn what is understood locally about ESOPs.Focus on what concerns exist from both the founder and employee perspectives. Note, we’ve found that different teams within a startup often have varying degrees of knowledge on stock option plans. Engineering and product teams tend to know more because they’ve generally been more exposed to ESOPs.

- Speak to other founders

Some companies are further along in their ESOPs journey than others. Chat with other founders in your ecosystem to learn about their initial challenges, how they addressed them, the ultimate benefit (or lack thereof) they’ve seen from instituting ESOPs, and how they structured these plans.Some startups only provide them for high-performing employees, while others offer them to all team members. Both approaches have their merits, but we usually recommend the latter to promote a sense of company-wide ownership.

- Conduct company-wide learning sessions to improve understanding and share your excitement.

Develop engaging learning sessions that address how ESOPs work and common questions or concerns. Make sure your enthusiasm shines through and express why you’re so excited for your employees to share in the company’s long-term upside. This approach will help get people on board and develop an even greater sense of excitement.

- Craft an ESOP strategy that considers employee needs.

After taking the actions above, see if there are ways you could address employee needs. For instance, some may prefer more immediate liquidity after the initial vesting period versus cashing out during later, big liquidity events. Consider adding secondary purchases as you raise additional rounds.

For further insights and detail on ESOPs, check out Accion Venture Lab’s ESOPs Overview and Best Practices.